Smart city tech company SenSen’s (ASX: SNS) revenue is up, cash receipts have increased and loans are repaid. Oh, and yeah, it is facing a lawsuit and laying off employees to cut costs.

For most companies, the latter would be big deals; but for SenSen, they are minor inconveniences requiring brief mentions.

In Q2 FY23, the Company recorded customer cash receipts of $2.6 million, representing a 72% increase on Q2 FY22. In the first half of 2023, it received customer cash receipts of $5.2 million, a 54% increase on H1 FY22. Moreover, it has cash reserves of $3.7 million, versus $3.2 million at the end of September 2022.

The Company is in a sweet financial position following the receipt of a $2.3 million tax return incorporating the company’s R&D grant. It helped fully repay a loan of $1.5 million from Rocking Horse Capital. To replace this loan, the Company was successful in obtaining an interim facility with Rocking Horse Capital, based on a completed R&D of $1.1 million.

Now, its annual recurring revenue stands at $8 million, with SenSen hoping to approach $10 million by the end of FY23.

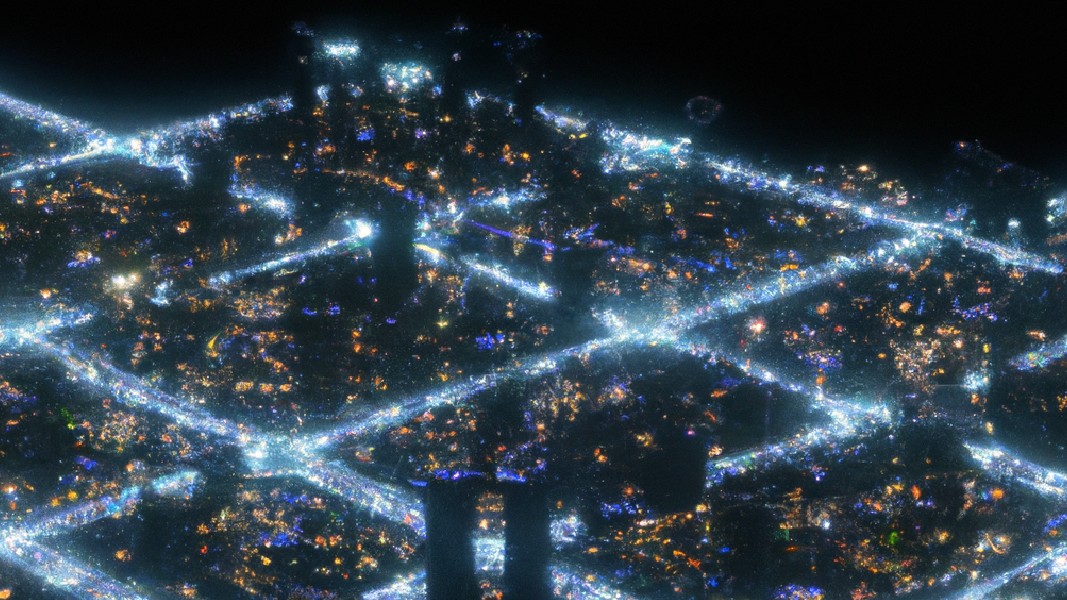

SenSen is an artificial intelligence-based data fusion enterprise that helps customers automate various processes. The Company has created solutions for a range of businesses, including Smart Cities, Casinos, Airports and Retail. It has clients on four continents, with a prominent presence in Australia, New Zealand, Singapore, USA, Canada, India and UAE.

The numbers will have you believe that all is rosy in SenSen’s world. However, the Company is undertaking an organisational restructure, laying people off to ensure it reaches its revenue target. One part of this involves laying off 26 full-time employees and two roles being reduced to part-time capacities. Given that the Company spends over $2 million on employee costs, these layoffs—along with restricting other controllable expenditures—will allow SenSen to save $2.5 million annually.

Moreover, the Company is also being taken to court for patent infringement claims. On December 16, 2022, the Company reported that it had been served with Federal Court of Australia proceedings by the solicitors for gaming company Angel Group Co., Ltd and Angel Australasia Pty Ltd. As per the claim, SenSen has infringed two of Angel’s Australian patents. The Company states otherwise.

In 2019, the two companies came together via a $10 million deal, wherein Angel Playing Cards company became the official distributor of SenSen’s SenGAME. According to SenSen, Angel owes the Company distributor fees. SenSen plans on defending these proceedings and even filing a crossclaim against Angel to claim relief for “unjustified threats of patent infringement and invalidity of the Angel patents in the suit”.

It does not expect this trial to affect its business, given that its gaming arm contributes less than 10% of revenue. However, it could hurt the Company’s reputation.

A lot hangs in the balance for SenSen. Over the past six months, between August 2022 and January 2023, the Company’s share price has fallen by nearly 50%, reaching $0.049 in January.

- Ovanti’s iSentric signs contracts worth $14.4m with Malaysian commercial bank - June 27, 2024

- Baby Bunting fights back from retail downturn with 5-year strategy, includes Gen-Z focus and self-funded growth - June 27, 2024

- CLEO meets with US FDA to develop strategy for ovarian cancer test launch - June 26, 2024

Leave a Comment

You must be logged in to post a comment.