As medical devices now have increased in demand for homecare, preventative treatments, and early diagnosis, it is no longer applicable strictly to the hospital diagnostic and treatment settings, but also other areas of healthcare such as health insurance. Thanks to this, medical imaging software and radiology company IMEXHS (ASX: IME) has secured another deal in South America with Famisanar, Colombia’s fifth largest insurance provider, through its wholly owned subsidiary RIMAB.

Being RIMAB’s first contract win, this contract is expected to contribute approximately $1.1 million in Annual Recurring Revenue (ARR) for IMEXHS. Famisanar itself currently caters to over 2.4m patients across 16 departments in Colombia.

The initial contract is for four months with automatic four-month renewals thereafter. Under the terms of the agreement, RIMAB will perform Famisanar’s MRI studies for the patients across the Cundinamarca region, including those in the capital city of Bogota. The agreement includes a fixed monthly package of 1,500 MRI studies with an option to increase this volume. The new deal requires no capital expenditure and the Company will make use of the medical facilities across RIMAB’s network of partners.

IMEXHS Co-Founder and CEO Dr Germán Arango commented, “We are delighted to partner with one of Colombia’s most important insurance providers. Our ability to provide high-tech medical imaging technology as well as patient-centric radiology services thanks to our 150 plus highly trained radiologists makes our offering unique across Latin America and most parts of the globe.”

The Company has already commenced operations and billing of this contract in February 2023.

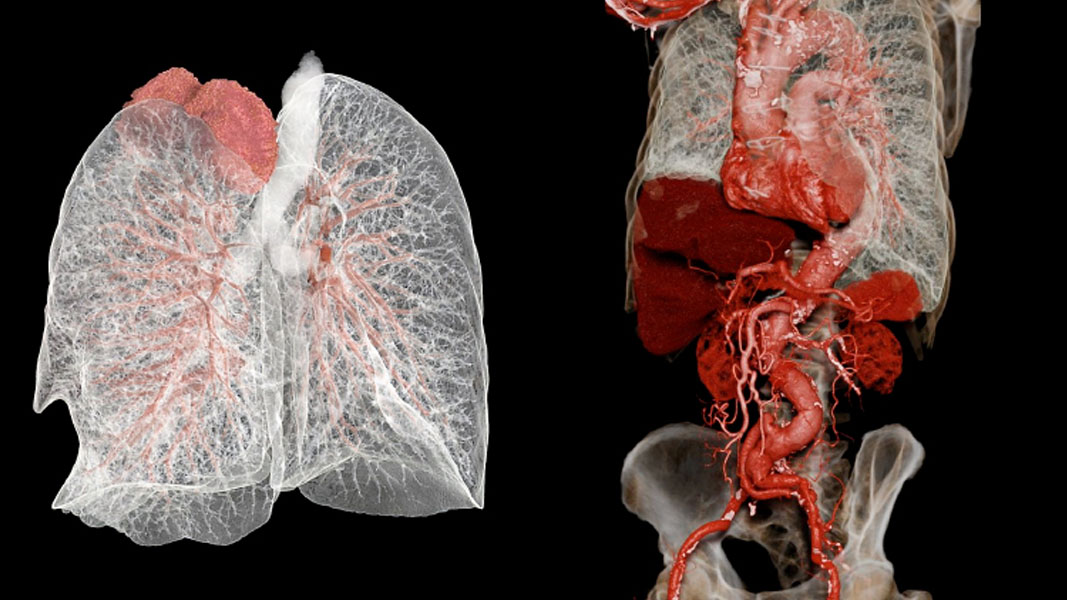

With a background in neuroradiology & software engineering, IMEXHS provides cloud-based medical imaging software and radiology services, as well as outsourcing of imaging facilities and teleradiology to hospitals and medical facilities in 18 countries including Colombia, the US, and Australia. Founded in 2012, IMEXHS develops software as a service (SaaS) imaging solutions that includes a Picture Archiving and Communications System (PACS), a Radiology Information System (RIS), a Cardiology Information System (CIS) and an Anatomical Pathology Laboratory Information System (APLIS).

IMEXHS’s solutions are completely cloud-based, vendor neutral and zero footprint, with no need for installed software, primarily to improve the quality of life of patients and doctors by developing cutting edge technology to address real needs of physicians, hospitals, clinics and diagnostic centres while promoting positive performance, productivity, and cost efficiency.

IMEXHS wholly owns RIMAB, which is a company formed by a group of radiologists specialising in medical imaging service (MRI, CT, ultrasound, mammography, X-ray, and many more), radiology centre outsourcing, and teleradiology. RIMAB’s current operations are currently based in Mexico, Spain and Colombia, providing a solution that would allow healthcare providers to share the information of diagnostic images in an easy and safe way and ensure quality care in the shortest time possible.

IMEXHS reported a revenue of $17.1m in FY22, which is a 28% improvement compared to previous year, and up 34% on a constant currency basis. Its underlying EBITDA loss of ($0.1m) is a $1.3m improvement versus pcp loss of ($1.4m). It also recorded a $1.1m debt which was down from $2.4m on pcp. At the end of the financial year, the Company holds $1.9m cash at bank.

- IPO Watch: The Australian Wealth Advisory Group set for ASX entrance - December 15, 2023

- Harris Technology gears up for Christmas as consumer electronics and household tipped to be among most popular purchases - November 27, 2023

- Linius Technologies sprints into the US college sports with automated game highlight technology - November 23, 2023

Leave a Comment

You must be logged in to post a comment.