After two “remarkable” attempts at business expansion, with one landing in hot water with the ASX while the other one completely flopped, shares in wealth management app Douugh (ASX: DOU) remains confident that the glass is still half full because hey, they say third time’s a charm. The Company claimed that its super money app has shown excellent early growth signs after phase one was launched in Australia sometime in November 2022, hoping that it will soon help recoup the $5 million revenue loss in the December half.

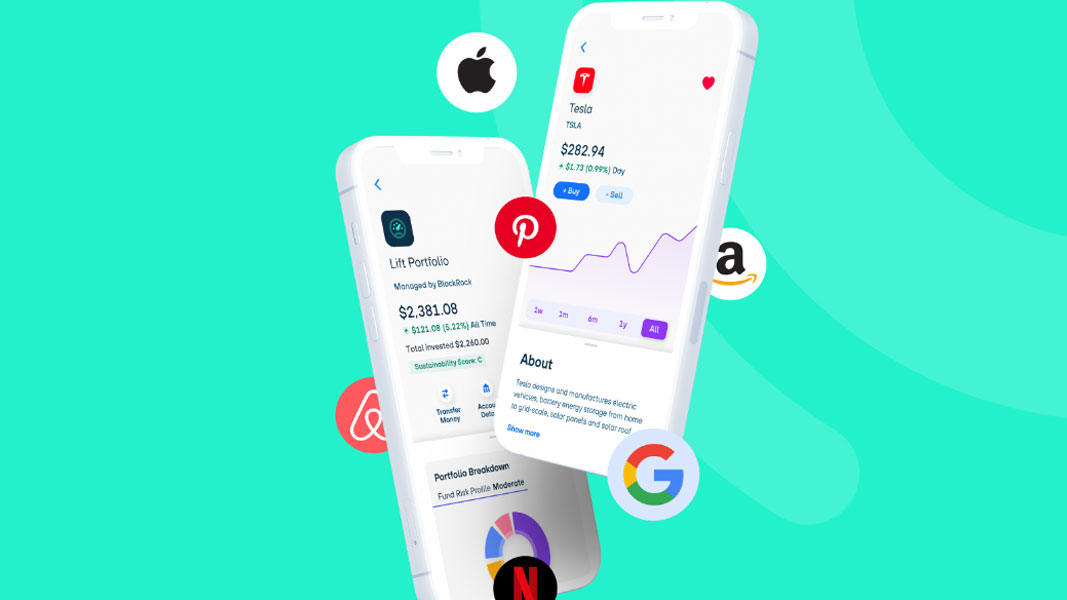

The super app was developed as a part of Douugh’s acquisition of sustainable investment platform Goodments, which it purchased for $1.5m in January 2021. Douugh recently launched a micro-investing service on the app that enables Australian consumers to automatically invest in one of six diversified portfolios run by asset management giant BlackRock.

Some key achievements from the super app include approximately $5.4m in Funds Under Management (FUM) generated with no paid marketing spend since launch, with around 1,200 active customers on the platform. The Company is also in the final stages of development of its card and cash flow lending product prior to turning on paid marketing activities. The new lending product is scheduled to be released in early Q4 FY23. The average number of single stock trades per month per user has almost doubled from 2.8 to 4.3 since November 2022, and since launching monthly subscription fees, revenue has increased by 220%.

Douugh CEO and Founder Andy Taylor commented, “We are pleased with the progress to date with no marketing spend and have already validated a lot of our key assumptions.”

“These initiatives will continue in the lead up to the launch of the second phase of the service, our reimagined card & account offering. This launch will mark the start of a targeted advertising campaign to promote the Dough brand and value proposition to a mass market audience, with a specific focus on the early adopter Gen-Z segment initially to stimulate virality.”

Another flagship feature boasted by Douugh is the autopilot feature that enables customers to set, forget and auto-invest money for long-term growth automatically. It allows Douugh to pull directly from a connected bank account, with customers able to set how much to invest, how often to invest and when to start. Customers can then choose how much of that recurring investment goes to a specific portfolio or individual shares, with autopilot taking the reins from there on out. Sixty seven percent of new Douugh users who funded their account have enabled this feature, which increased by 207% since November 2022.

Douugh made it into the ASX on 6 October 2020 when it raised $6m via a reverse takeover of Ziptel, debuting at 3 cents per share. Two weeks later, its share price went up by 983% to 32.5 cents per share.

It wasn’t long until it first got into trouble with the ASX, in which a piece of detailed partnership plans for a buy now, pay later offering targeting the US market (that were later revealed to be fellow listed fintech stock Humm) and a $12m capital raising was published by the Australian Financial Review in early December 2020 without notifying the ASX first. Douugh then told the ASX that the board did not authorise the release of the information to the Australian Financial Review, however, Andy Taylor as Managing Director did.

Douugh’s dream of launching an entire bank with saving and investing products in Australia recently had to be put on ice following the unfortunate closure of its Australian banking partner Volt Bank in June 2022. Having already completed onboarding and integration in the US as well as spending the first half of 2022 adapting it for Australia, all the work the Douugh team had put into the software integration was nullified by Volt Bank’s downfall.

Though the Goodments acquisition was a forerunner of the super app that Douugh is pinning its hopes on, it came with a ruffling backstory too. It all began on 21 December 2020 when Douugh requested a two-day voluntary trading halt due to being in the final stage of acquiring a millennial-focused investing company. This was extended consecutively all the way to 6 January 2021, once again angering the ASX, which said it had identified a potential breach of its listing rules of share placement and the backdoor listing transaction.

Trading at $0.009 today (91% down from IPO price) and having been jumping through a lot of hoops to be where it is, can the super app turn the tide for Douugh to roll away from negativity soon?

- IPO Watch: The Australian Wealth Advisory Group set for ASX entrance - December 15, 2023

- Harris Technology gears up for Christmas as consumer electronics and household tipped to be among most popular purchases - November 27, 2023

- Linius Technologies sprints into the US college sports with automated game highlight technology - November 23, 2023

Leave a Comment

You must be logged in to post a comment.