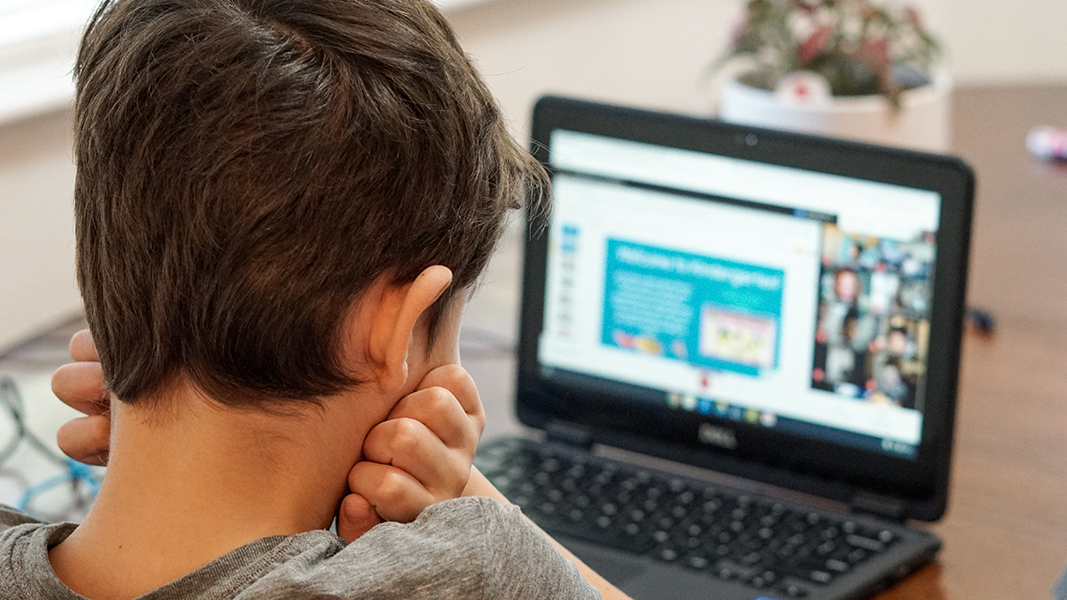

According to The Australian Institute of Family Studies, 97% of households with children aged under 15 years have access to the internet, with an average of seven devices per household. While the internet offers endless opportunities for kids to learn, explore, connect, and be exposed to the technologies that will be useful in later life, it also poses a double edged sword as people with dark intentions and malevolence coexist in cyberspace too.

Almost two-thirds (60%) of Australian children aged 8-12 are exposed to at least one form of cyber risk. That included 44% who have experienced cyberbullying and 12% who are at risk of gaming disorder. More than a third of 13 to 19-year-olds have experienced unwelcome sexual contact.

Hoping to become a panacea and help parents and educators to prevent children from unsafe situations, family-focused cyber safety company Family Zone (ASX: FZO) has been focusing on cyber safety technology to improve online safety for children and teenagers, and it seems that many parents and educators across the US, Europe, Australia, and New Zealand are sharing the same vision. The Company’s Group Annual Recurring Revenue (ARR) saw a $6m increase in the March quarter compared to the previous quarter, hitting $91 million. Family Zone sees this as an exceptional result given the delayed start to the UK edutech selling season and active churning of non-core (i.e. non-school) customers as part of an efficiency drive.

Other key achievements within the quarter include strong margins and growth in average revenue per student from the Education division, now passing through $6.2m p.a. compared to $6m last quarter. This reflects Family Zone’s broadening product range and capability in cross and upsells. Average revenue per student across the group (Education and Global divisions combined) remains stable from the previous quarter at $8. Continued growth is expected with a 2-3 year target of $10 per annum.

As a global provider of digital safety and wellbeing solutions, Family Zone developed online controls to filter out the harmful aspects of the digital world, such as exposure to adult content, cyberbullying, privacy issues, sleep disturbances, and even potential cybercrime. Its customer-offering Qustodio app helps parents to manage screen time, block harmful content, set rules for social and gaming apps, and track smart devices at home, school, or on the go.

Family Zone is currently left with $16.93m cash at bank, but might raise shareholders’ question of how the Company will maintain sustainable operations with a cash outflow of $10.57m this quarter and a cash runway of 1.6 quarters. However, the Company revealed that it is expecting seasonally higher cash inflows in the upcoming quarters, therefore operating cash flows are expected to improve.

Taking pride in demonstrating stable fixed costs for 3 quarters in a row, Family Zone will continue to focus on cost reduction and improving cash inflows with the aim to reach run-rate break-even operating cash flows in the June quarter.

Moreover, it recently raised approximately $20m through the completion of a share placement on 9 March 2023. On the same day, Family Zone converted $5m of the existing working capital facility with Northcity Asset Pty Ltd to FZO shares, reducing this future commitment of capital. The Company is now in a position to attract conventional debt funding.

As of 31 March, Family Zone had a record 1,125,433 student licenses and in excess of $6m of Proof of Concept trials. Expecting a huge pipeline & exciting launches ahead with a record weighted pipeline of more than $11m (up 80% YoY), the Company also claimed that it is currently in the bidding process of million dollar deals across all markets and enjoying the progress of recent product launches.

Family Zone is also in the process of introducing the Qustodio app in the US through its established US schools footprint. Sign-ups to Qustodio’s Community programs continue to grow with 34% of the US schools within the network onboarded. To date the Qustodio app has been launched to 104,000 parents and is achieving ~ 3% parent take-up.

- IPO Watch: The Australian Wealth Advisory Group set for ASX entrance - December 15, 2023

- Harris Technology gears up for Christmas as consumer electronics and household tipped to be among most popular purchases - November 27, 2023

- Linius Technologies sprints into the US college sports with automated game highlight technology - November 23, 2023

Leave a Comment

You must be logged in to post a comment.