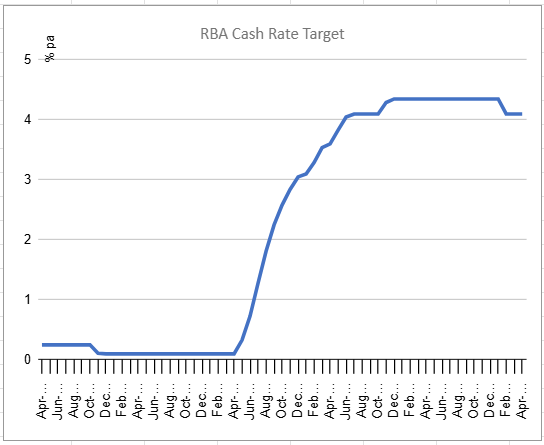

The RBA’s benchmark interest rate was left unchanged at 4.10% at the Bank’s 31 March-1 April Board meeting, with our central bank deciding to leave well enough alone ahead of a swag of political and economic uncertainties hitting markets over coming weeks. This left the RBA rate a touch under the existing US Fed Funds Rate of 4.25-4.50%, which was left unchanged at last month’s Fed Reserve Board meeting.

Source: RBA, St Louis Fed and TCN

The RBA-prepared commentary accompanying the April rates decision was cautiously optimistic.

It noted that while Australia’s key underlying inflation measures had continued to trend lower, they had still not yet returned to the midpoint of the Bank’s inflation target band of 2-3% on a sustainable basis. In a minor set-back for further near term rate cuts, the RBA commentary specifically stated that the RBA was not yet confident that the recent downtrend in inflation would continue.

The commentary was not without optimism though. It expressed confidence that current monetary policy settings left the Bank “well placed to respond to international developments if they were to have material implications for Australian activity and inflation.” These developments would clearly include any economic turbulence caused by the imminent raft of US tariffs to be announced as part of the Trump Administration’s so-called ‘Liberation Day’.

The RBA rates decision commentary highlighted the positive trends showing up in the Australian economy. These included an apparent recovery in private domestic demand, aided by a pick-up in real (prices-adjusted) household incomes and an easing in some measures of financial stress.

The RBA was still seeing tight conditions in the domestic labour market – this despite the employment decline reported in February that excited those wanting another rate cut sooner rather than later.

While the RBA was pleased that wage pressures have eased a little more than expected despite these tight labour market conditions, it expressed concern about the ongoing drag on Australia’s economic performance by still sub-par productivity growth. The RBA also mentioned that businesses in some sectors were continuing to struggle to pass on cost increases to their clients in the face of ongoing weak demand.

Looking ahead, the RBA commentary made mention of multiple potential challenges to Australia’s economic growth prospects.

Domestically, the Bank stated that while growth in household consumption was expected to further increase as income growth rises, there remained a risk that consumption would surprise on the downside. The latter scenario would, in turn, exert downward pressure on output growth and deliver a sharper deterioration in the labour market than was currently expected.

Internationally, the RBA conceded that there were significant risks to the outlook for key overseas economies. The April RBA rates decision commentary specifically stated that “recent announcements from the United States on tariffs are having an impact on confidence globally and this would likely be amplified if the scope of tariffs widens, or other countries take retaliatory measures”. The RBA added that other central banks were also watching these unfolding global policy developments – ‘RBA-speak’ for watch this space!

So where to for Australian interest rates?

The RBA’s April commentary expressed confidence that, aided by a still restrictive monetary policy settings, Australia’s underlying inflation rate would continue to move towards the Bank’s inflation target over the longer term. At the same time though, it pointed out that there were continued risks to this outlook.

Many money market traders are still punting on another RBA rate cut at the next RBA Board meeting (to take place over 19-20 May), but this view is heavily premised on the March 2025 CPI (due 30 April 2025) surprising on the downside and President Trump’s pending tariffs not re-opening the global inflation genie’s bottle.

- FBR’s tech could help reduce housing construction-related cost pressures - August 21, 2025

- June 2025 quarter CPI no roadblock to August RBA rate cut - July 31, 2025

- Australia’s GDP inches higher in March 2025 quarter - June 5, 2025

Leave a Comment

You must be logged in to post a comment.