RBA benchmark rate is cut by 25 basis points at the May Board meeting

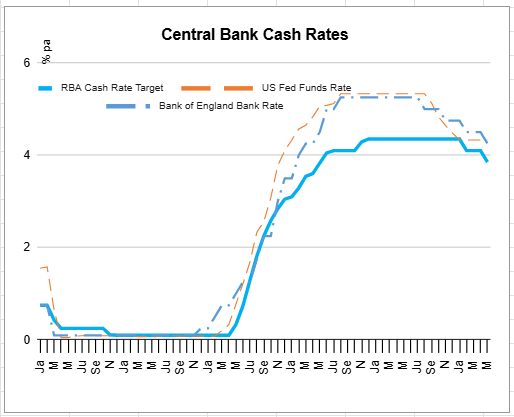

As was widely expected by all and sundry, the RBA’s benchmark interest rate was reduced by 25 basis points to 3.85% at the 19-20 May RBA Board meeting. Policy makers even briefly considered whether a 50 basis point cut was an appropriate course of action. The RBA benchmark rate is now comfortably below equivalent central bank rates in the US (Effective Fed Funds Rate:4.33%) and the UK (Bank of England Bank Rate: 4.25%). The last time the RBA rate was in sub-4% territory was just ahead of the June 2023 Board meeting.

Source: RBA, St Louis Fed, Bank of England and TCN

A shift to a less restrictive policy setting, as inflation concerns wane

The RBA Board justified the rate cut on the basis of continued improvement in domestic inflation indicators – and gave itself a nice little pat on the back – saying that “higher interest rates have been working to bring aggregate demand and supply closer towards balance.”

From a look-ahead perspective, the RBA currently expects underlying inflation to be around the mid-point of the 2–3% target range over the coming year. However, headline inflation was forecast to rise over the same timeframe, as “temporary factors unwind.”

But the RBA still holds concerns about the broader global outlook

Much of the May meeting rates decision commentary was devoted to RBA policy makers’ macro-economic concerns. It noted that the past three months had seen increased uncertainty in the world economy and bouts of unwelcome volatility in financial markets.

While there was some welcome respite in the global trade war set in motion by US President Trump’s ‘liberation day’ tariffs that settled financial markets, the RBA commentary noted “there is still considerable uncertainty about the final scope of the tariffs and policy responses in other countries.” All this while long-lived geopolitical events, headed by conflicts in Ukraine and the Middle East, remain unresolved.

The rates commentary stated the bleeding obvious, namely that the abovementioned uncertainties have applied a brake to global economic growth, as spending and investment decisions are being delayed. It added that Australia’s economic growth and inflation outlook had also been adversely impacted by these uncertainties.

RBA mostly happy with current economic conditions

The rates decision commentary indicated that the RBA was comfortable with the current performance of the Australian economy. It pointed to the recovery apparent in private domestic demand, a pick-up in real household incomes, and some easing in selected measures of financial stress. In the jobs market, it reflected on a range of indicators suggesting that labour market conditions were still tight. On the downside, the RBA saw evidence that corporates in some industrial sectors were struggling to pass on cost increases to final prices. It also again mentioned that productivity growth was failing to pick up and growth in unit labour costs had remained high.

Looking into its crystal ball, the RBA saw “uncertainties about the outlook for domestic economic activity and inflation stemming from both domestic and international developments.” Here the Bank is clearly on ‘observe and monitor’ mode.

So where to for Australian interest rates?

While the RBA pushed the rate cut button at its May 2025 meeting, underwritten by a “more balanced inflation outlook”, the accompanying rates decision commentary was like the proverbial ‘Curate’s Egg’ – good only in parts.

The commentary made note of policy makers’ concerns about the outlook, expressing disquiet about “the heightened level of uncertainty about both aggregate demand and supply.”

The RBA is now of the belief that its current monetary policy stance, which it sees as “somewhat less restrictive”, is appropriately positioned to “respond decisively to international developments if they were to have material implications for activity and inflation in Australia.” In other words, RBA policy makers are happy to now sit back and monitor events offshore and will react only when new developments come to light – all while retaining its focus on delivering price stability.

Traders’ view of the future direction of Australian short term interest rates remains much more relaxed. They are happy to look through the possibility of further trade war shenanigans, with the domestic bank bill futures curve still pricing in at least another two 25 basis point rate cuts by the end of calendar 2025.

- FBR’s tech could help reduce housing construction-related cost pressures - August 21, 2025

- June 2025 quarter CPI no roadblock to August RBA rate cut - July 31, 2025

- Australia’s GDP inches higher in March 2025 quarter - June 5, 2025

Leave a Comment

You must be logged in to post a comment.