Australia’s economic growth, as measured by the ABS-compiled chain volume GDP statistics that adjust for price increases, edged higher by a lower than expected 0.2 per cent in the March 2025 quarter. The accompanying ABS-prepared commentary noted that extreme weather events dampened domestic demand and reduced exports. It added that weather impacts were particularly evident in mining, tourism and shipping.

The accompanying annual (through the year) basis increase was just 1.3 per cent. The latter figure, also shy of market expectations, matched the annual movement reported in the final quarter of last year.

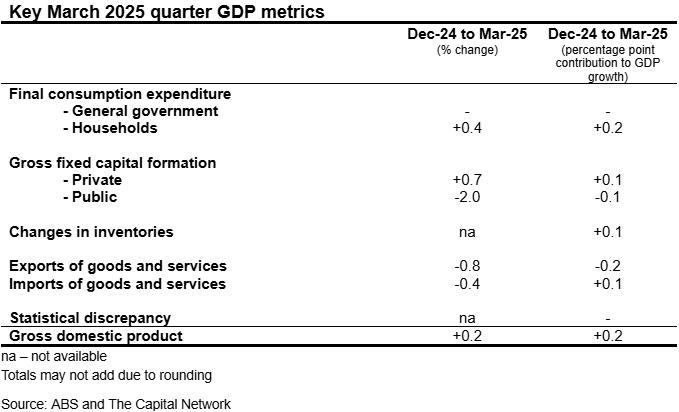

The headline quarterly economic growth figure was kept in the black by modest gains in household spending plus the construction (dwelling and non-dwelling) components of private sector investment. On a down note, though, both the public sector investment and net exports (exports minus imports) components were growth drags over the first three months of calendar 2025. Indeed, the public sector as a whole recorded its worst drag on growth since way back in the September 2017 quarter.

Household spending rose by 0.4 per cent in the March 2025 quarter, down on the upwardly revised 0.7 percent gain reported in the prior 3-month period. Delving deeper into the March 2025 quarter household spending figure, ‘essential spending’ advanced by 0.4 per cent, led by a strong rise in the electricity, gas, and other fuel categories. The ABS noted that the latter bounce reflected both an uplift in electricity usage due to warmer than average summer conditions and reduced electricity bill relief payments to households. However, growth in discretionary spending tailed off after a strong prior quarter showing.

Turning to the investment components, private investment increased by 0.7 per cent, delivering a slight positive contribution to March 2025 quarter GDP growth, as dwelling investment advanced. Non-dwelling construction also rose, led by mining and electricity projects. However, private sector investment in machinery and equipment and public sector investment retreated over the quarter.

The net trade (exports less imports) component of our GDP made a small negative growth contribution, as a -0.8 per cent drop in exports was only partly offset by a -0.4 per cent fall in imports.

In a positive development for aggregate household finances, the household savings ratio rose to 5.2 per cent in the March 2025 quarter, from 3.9 per cent in the prior quarter, as wages growth continued to feed through. This savings metric was last above 5 per cent back in September 2022 quarter.

However, productivity – or lack thereof – remained a proverbial ‘Achilles Heel’ in our GDP data. The GDP per hour worked metric was 1.0 per cent lower on an annual basis.

Net-net, with the headline March 2025 quarter GDP increase shy of market expectations and assuming key underlying inflation measures stay under 3 per cent in the near-term, there is a very real chance that the RBA will loosen monetary policy another notch at its next meeting on 7-8 July 2025. This aligns with the market’s view, with another 25-basis point cut to 3.6% now priced into the domestic interest rate futures curve.

However, perhaps the more pressing question is, will any further reduction in interest rates be enough to stir the ‘animal spirits’ of corporate Australia, which is collectively not showing an eagerness to invest in the face of challenging market conditions both here and abroad.

- FBR’s tech could help reduce housing construction-related cost pressures - August 21, 2025

- June 2025 quarter CPI no roadblock to August RBA rate cut - July 31, 2025

- Australia’s GDP inches higher in March 2025 quarter - June 5, 2025

Leave a Comment

You must be logged in to post a comment.