Australia’s broadcast technology sector is experiencing rapid global expansion, driven by demand for IP video production tools and live streaming capabilities across enterprise, education, and media. Within this niche, BirdDog Technology (ASX:BDT) has made a name for itself with high-performance, Network Device Interface (NDI)-enabled video solutions. Now, the company is preparing for a major structural shift as it seeks shareholder approval to delist from the ASX and implement a 100% off-market share buy-back.

Buy-Back Offer Rises to 7 Cents

Originally announced at $0.05 per share, BirdDog has lifted its proposed buy-back price to $0.07 per share, following engagement with shareholders.

The revised offer reflects:

- A 126% premium to the closing price of $0.031 on 3 April 2025 (the last trading day before the initial delisting proposal).

- A 112% premium to the 15-day VWAP of $0.033.

- And a 100% premium to the 30-day VWAP of $0.035.

Institutional Backing Strengthens the Proposal

Three substantial institutional shareholders, collectively holding 16.9% of issued shares, have confirmed their intention to vote in favour of both the delisting and buy-back resolutions. They have also committed to fully participating in the buy-back prior to BirdDog’s planned removal from the ASX.

Updated Meeting Date and Process

The Extraordinary General Meeting (EGM) has been rescheduled to 22 July 2025. All proxy votes submitted before this latest update are now void. Shareholders must complete a new proxy form or attend the meeting in person to vote.

Key Dates Investors Need to Know

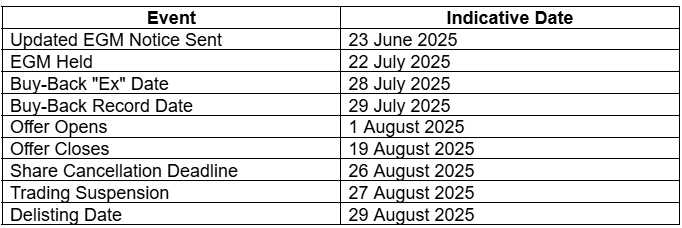

Assuming shareholder approval at the EGM, BirdDog’s delisting and share buy-back will follow this indicative timeline:

Refocusing Beyond the ASX

BirdDog’s strategic decision to delist reflects a broader trend among smaller, globally focused Australian tech firms that are choosing to operate privately or explore alternative capital pathways. The company maintains a strong product offering across Pan, Tilt, and Zoom (PTZ) cameras, NDI-enabled converters, cloud software, and broadcast monitors, with a customer base that includes professional video producers and enterprise clients worldwide.

BirdDog’s updated offer provides a more attractive exit path for shareholders as the company transitions to private ownership—pending shareholder approval next month.

- Semtech and EMASS Bring Intelligence to the Edge as AI Meets Long-Range IoT - December 10, 2025

- Control Bionics Moves to Fully Acquire NeuroBounce Program as EMG-Based Performance Tech Gains Momentum - December 3, 2025

- SKS Technologies Moves to Expand NSW Footprint With Delta Elcom Acquisition - November 18, 2025

Leave a Comment

You must be logged in to post a comment.