Online tech retailer Harris Technology (ASX: HT8) has delivered a strong lift in gross product margins across FY25, thanks to a strategic pivot towards refurbished technology products that has produced big growth opportunities for the Company in an otherwise subdued retail market.

Despite a drop in total sales revenue for the year ended 30 June 2025 to $13.6 million – down from $16.7 million in FY24 – Harris Technology’s gross margins climbed to 35.8%. This marks a significant improvement from 29% in FY24 and 15.5% in FY23, driven by the Company’s sharpened focus on high-margin refurbished tech goods.

CEO Garrison Huang said the move was designed to address Australia’s ongoing cost-of-living crisis, which has seen a marked shift in consumer behaviour.

“FY25 proved a challenging year for the retail industry amid macroeconomic pressures, but with an agile inventory strategy and established supply chain infrastructure, Harris Technology was able to consolidate its position as a leader in the refurbished tech market,” he said.

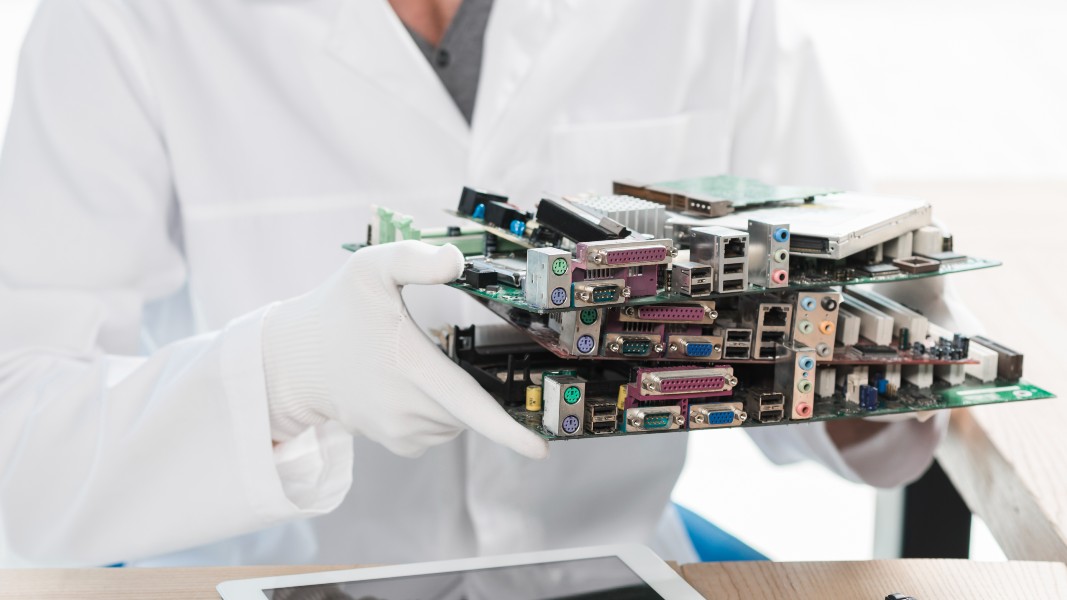

The Company’s Refurbished Tech division, which only emerged as a major revenue driver in recent periods, delivered two consecutive quarters of over $1 million in sales – signalling growing demand among price-conscious consumers. Harris Technology’s decision to scale down its range of low-margin new tech products freed up resources to invest further in this high-growth category.

Refurbished tech has become increasingly appealing to Australians looking to make smarter purchases without compromising on quality. When handled by reputable resellers like Harris Technology, who is authorised to sell via major online marketplaces such as Amazon and eBay, refurbished goods undergo rigorous testing, repairs, and quality checks before hitting the virtual shelves. This makes them functionally equivalent to new products, but at significantly lower prices.

Harris Technology has also bolstered its supply pipeline by partnering with new sources of used and excess tech, enabling a steady stream of inventory to meet rising demand.

Importantly, the shift in strategy has helped the company limit cash burn, with just a $0.1 million net operating cash outflow for the June quarter, while backed by $1.9 million in cash on hand and a $6.0 million undrawn financing facility. The position has enabled the Company to purchase larger volumes of stock where resale prices are attractive.

While retail headwinds persist, Harris Technology’s success in building a profitable niche amidst industry-wide slowdowns highlights the advantages of an agile, data-led inventory strategy and a keen understanding of evolving consumer priorities.

“Heading into FY26, we see substantial growth opportunities for refurbished tech and are excited to see an increasing demand as consumers see the cost-savings they offer,” Huang added.

“We look forward to increasing our supply to the market in FY26 through new partner engagements.”

- Harris Technology boosts retail margins in FY25 through growth of refurbished tech - July 22, 2025

- Harris Technology continues growth with refurbished tech sales surpassing second $1M in just three months - October 28, 2024

- Income Asset Management flags positive cashflow via strategic platform partnership with Perpetual - October 7, 2024

Leave a Comment

You must be logged in to post a comment.