The media reporting of the US Federal Reserve providing temporary liquidity to primary dealers, via re-purchase (repo) agreements, appears to overstate the funding stress in this market. The repo market is where primary dealers borrow cash from the Federal Reserve for a short period of time against securities like US Treasury notes or mortgage backed securities.

From the Financial Times 15th January 2020. https://www.ft.com/content/8837ccd4-3712-11ea-a6d3-9a26f8c3cba4

Earlier on Tuesday, banks gobbled up $82bn in temporary liquidity from the Fed in the form of overnight and two-week repo loans. Bids for the two-week funding were $43.2bn for the $35bn on offer. A similar operation on January 7 was oversubscribed by roughly the same amount, while another two days later was close to fully subscribed.

From the Wall Street Journal: 14th January 2020. https://www.wsj.com/articles/fed-adds-82-billion-to-financial-markets-11579016506

Big banks’ demand for longer-term Federal Reserve liquidity flared up again on Tuesday….The Federal Reserve Bank of New York said it intervened twice via repurchase agreements….Collectively, the Fed added $82 billion in temporary liquidity to the financial system. On Monday, the Fed had added $60.7 billion overnight liquidity.

Sounds dramatic. $142.7 Billion added in two days. These media outlets ignore the fact that as much as there is new liquidity, there is previous liquidity that is maturing on the same day.

On Monday, the 13th January 2020, $66 Billion of repo’s matured. In fact, the Federal Reserve removed $5.7 Billion of liquidity. This is much less dramatic that implying that $60.7 Billion was added.

On Tuesday, the 14th January 2020, $70 Billion of repo’s matured. Only $12 Billion of liquidity was added, not $82 Billion.

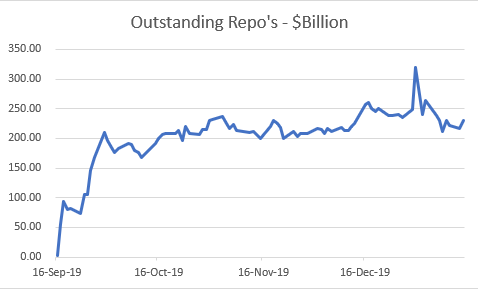

Since the 16th September 2019, the outstanding repo’s have grown from zero to a current outstanding of $229 Billion, with a 31st December spike to $319 Billion.

Although the rise in Repo’s is a cause for some concern, it is not to the degree that is implied by the media. The participants who have access to the Repo market are primary dealers, banks, government sponsored enterprises and money market funds. Normally these participants can deal with each other and square off their surplus/deficit funding positions. This current repo issue is reflective of an issue that some participants with surplus funds are declining to lend to other participants who are in deficit.

Maybe they don’t like the counterparty risk and/or they may not like lending against some mortgage backed securities. Instead the participants who are in surplus can place their funds directly with the Federal Reserve. The Federal Reserve can then on-lend to those participants in deficit.

It is an intriguing issue, but certainly doesn’t deserve the level of angst reflected in the media.

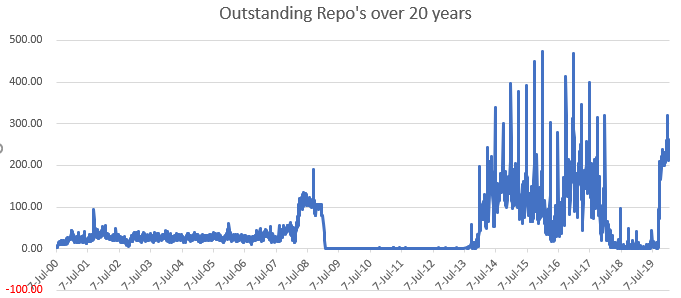

Below is a 20-year picture of outstanding Repo’s – the current balance is $229 Billion which will mature by the 28th January 2020.

- How the Chevron Doctrine decision could shake the environment and investors - July 10, 2024

- Why a tsunami of liquidity might be on its way - July 5, 2024

- A quick explainer on Hybrids and why people trade them - June 24, 2024

Leave a Comment

You must be logged in to post a comment.