We have seen a jump in the headline oil prices and related oil equity prices Brent spot price went above US$48/bbl / WTI spot price touched $46/bbl, especially in Nov-20 on the back of several positive announcements relating to Covid-19 vaccines. With potentially the first batch of vaccines becoming available before the end of CY20, the market has started to speculate what this could mean for oil demand in CY21 as life returns to normal. We note gasoline and diesel demand have recovered approximately 90%, whilst jet fuel demand remains at approximately 50%.

Spot prices have settled lower since hitting their recent highs. In the short-term we see potential headwinds:

Near-term demand issues. Increasing infection rates and lockdowns in parts of Europe and the U.S. could impact demand for oil again in the near-term. Note these regions are also now officially in their winter season which could make the next few months tricky. Also some are expecting the cases in the U.S. to spike post Thanksgiving – with most consumers failing to heed advice not to travel during the holiday (1.18 million passengers went through TSA checkpoints in the U.S. on 29 Nov-20 – this was the highest number recorded since 16 Mar-20).

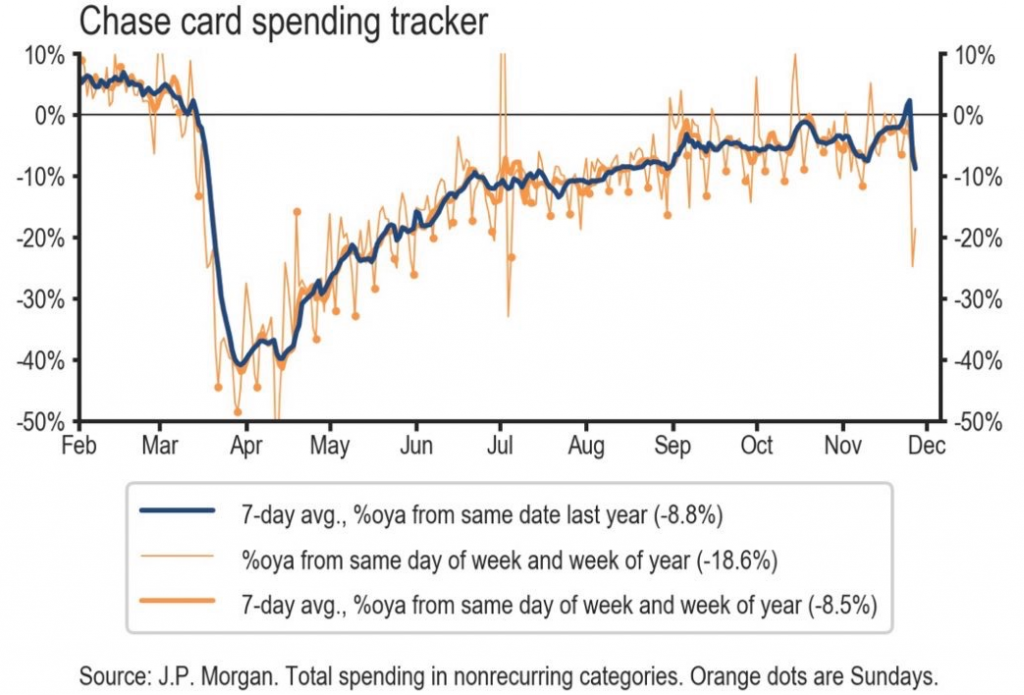

Consumers pulling back. JP Morgan’s latest card spending tracker reading saw a significant pullback recently. This likely reflects the lack of a fiscal deal in the U.S. which is stopping payments to get to the consumers. Lack of a deal could see consumer demand pull back further.

OPEC wrangling. Recent OPEC talks have been delayed by 2 days given officials need more time to come to an agreement. The balancing act between the need to further balance the oil market (by keeping barrels out of the market) and taking advantage of the rising oil prices (increase production and drive revenue higher) has divided OPEC. Lack of a deal on extending the output cuts could temporarily derail oil prices in our view.

On 10 Aug-20, the Banyantree Macro Multi-Asset Strategy initiated a tactical position in oil via direct equity plays (basket of oil companies). Last week we took profits on our tactical position in oil, given the strong returns and post the rally so far in 4Q20. Returns provided in the table below.As a reminder, the Banyantree Macro Multi-Asset Strategy is the unconstrained version of our SAA multi-asset strategies – since inception (1 Mar-17), this strategy has delivered 7.7% p.a.

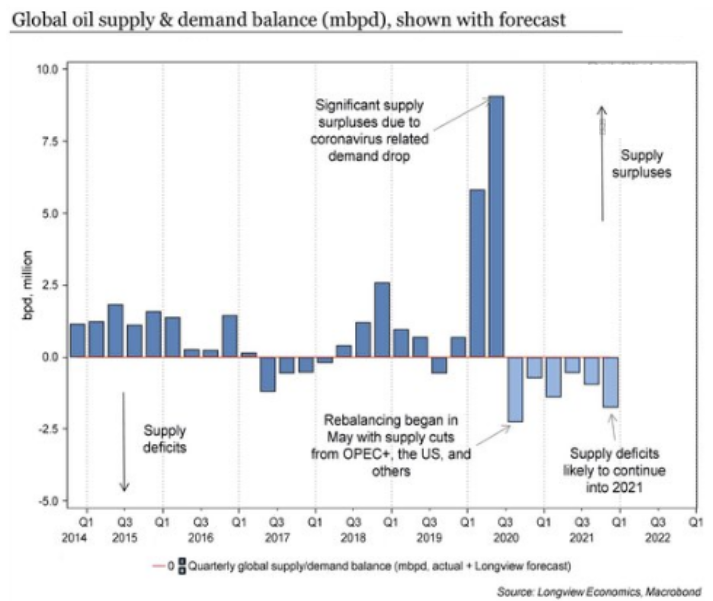

We remain comfortable with oil positions post these near-term headwinds. In fact long-term investors / markets may decide to look through the short term noise (reminder our tactical positions are short-term in nature regardless of our LT view). We do expect oil markets to tighten next year. The lack of FIDs in 2020 and the significant pull back in capital expenditure to protect balance sheets in 2020 will have an impact on supply. The impact to supply may come at the very same time demand starts to pick up in CY21.

Source: Longview Economics, Macrobond

Happy to discuss further. We have our preferred picks in the oil market to ride through this volatile period – please get in touch if you want to discuss.

- Quick Update: Who bought the dip?Iron ore update + more - August 14, 2024

- What if we are NOT in a new “commodities supercycle”? - August 1, 2024

- Who is going to power the AI boom? - May 30, 2024

Leave a Comment

You must be logged in to post a comment.