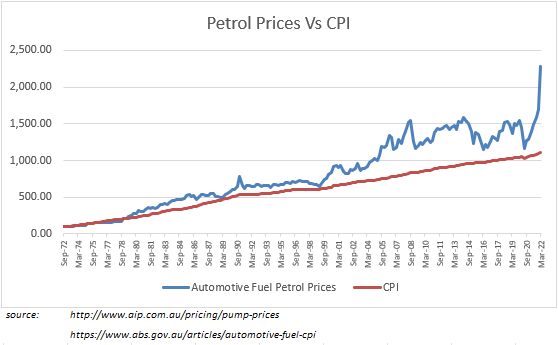

Do you ever get the feeling that when the ABS tell you the inflation rate is 3.5% for the year, that something just seems wrong? Go to the supermarket and don’t tell me a basket of goods hasn’t substantially increased in price. Meat and Livestock Australia said retail prices are up 10 per cent per kilogram compared to this time last year.

Companies are also shrinking their packaging. I have on good authority that Doritos is putting 5 fewer chips into their 9.25oz packets. In comforting corporate speak, Frito-Lay confirmed they shrunk the Doritos and said ”Inflation is hitting everyone…we took just a little bit out of the bag so we can give you the same price and you can keep enjoying your chips.” Shoot me.

Gatorade replaced its 32 oz size with a 28 oz bottle for the same price. This is an effective 14% price increase. The practise is so prevalent Reddit has dedicated a sub-reddit to the topic: https://www.reddit.com/r/shrinkflation/

According to the ABS, residential property prices have increased 23.7% over the last 12 months. The statisticians have converted this number into a 4% increase. The CPI doesn’t use property prices, it uses “homeowners equivalent rent”.

The Government doesn’t care about rampant property price inflation, it encourages it. It has created a false wealth effect, fueled by a 30-year cycle of falling interest rates. The State Government is now even contributing 25% of the price to first time home buyers. They are even conscripting Superannuation savings to the cause.

From the RBA: “The Governor and the Treasurer have agreed that the appropriate target for monetary policy in Australia is to achieve an inflation rate of 2–3 per cent, on average, over time. This is a rate of inflation sufficiently low that it does not materially distort economic decisions in the community. Seeking to achieve this rate, on average, provides discipline for monetary policy decision-making, and serves as an anchor for private-sector inflation expectations.”

By my reckoning, inflation is not sufficiently low, it is not anchoring inflation expectations and it is materially distorting economic decisions. Property is a tax-free investment for homeowners and tax deductible against normal income for investors. In 20 years, the established home price index has increased by over 4 times. A good proportion of economic resources are ploughed into the housing sector, rather than more productive activities.

And yet, despite all this, the RBA did not deem inflation high enough to lift interest rates this month. The official rate remains at .10%. Across in New Zealand, their Reserve Bank have already lifted interest rates to 1%. The NZ central bank project cash rates to reach 2.2% by year end. The US Federal Funds futures rate is trading at 2.26% by December this year.

As I have pointed out previously, a 2% increase in a standard 30-year mortgage rate will increase payments by 27%.

The RBA’s thoughts and prayers are with the Australian economy.

- How the Chevron Doctrine decision could shake the environment and investors - July 10, 2024

- Why a tsunami of liquidity might be on its way - July 5, 2024

- A quick explainer on Hybrids and why people trade them - June 24, 2024

Leave a Comment

You must be logged in to post a comment.