In a trillion-dollar industry so inundated by competitors, Aussie semiconductor company Archer Materials (ASX: AXE) has managed to stand out and make a name for itself with its unique qubit processor technology, the 12CQ chip, which is paving the path for mobile quantum computing devices.

It has the backing of the largest semiconductor chip producer, researchers on board and investors inclined. Archer has had a year of growth and shows no signs of slowing down yet.

In Q3 FY23, the Company stood well-capitalised with $24.4 million in cash and no debt, supplemented by an efficient use of funds. Additionally, it received a $1.02 million cash rebate from the Australian Federal Government’s Research and Development Tax Incentive program.

Commenting on third-quarter activities, Executive Chairman of Archer, Greg English, said, “During the Quarter, the Archer team successfully developed a fabrication process for the manufacture of wafer-based functional devices for its quantum electronic devices. The Company used industry standard semiconductor nanofabrication to facilitate the fabrication of potentially hundreds of advanced quantum electronic devices on a single silicon wafer.”

Archer’s innovation aims to realise mobile-compatible quantum processing to make your device super smart an super compatible with upcoming innovations in AI, AR, VR and more.

During the third quarter, Archer Materials also made progress in the development of its biochip technology. The Company’s team successfully developed a way to electronically control the sensitivity of incorporated graphene field effect transistor (gFET) devices, overcoming conventional limitations of gFET sensing.

English added, “Biochip development continued during the Quarter with the Archer team designing a strategy to rid the gFET sensor of signal interference caused by the screening layer and introduce practical device operation sensitivities. The Archer team applied innovation and collectively developed the software and incorporated the hardware with the biochip system platform to make an in-house device that allows the Company to achieve electronic modulation and tuning of gFET sensitivity.”

Thanks to its lean ‘fabless’ business model, unlike most companies in this space, Archer did not need to radically cut costs, reduce employee headcount, or push out capital expenditures for additional capacity, despite the higher cost of capital and semiconductor industry geopolitics.

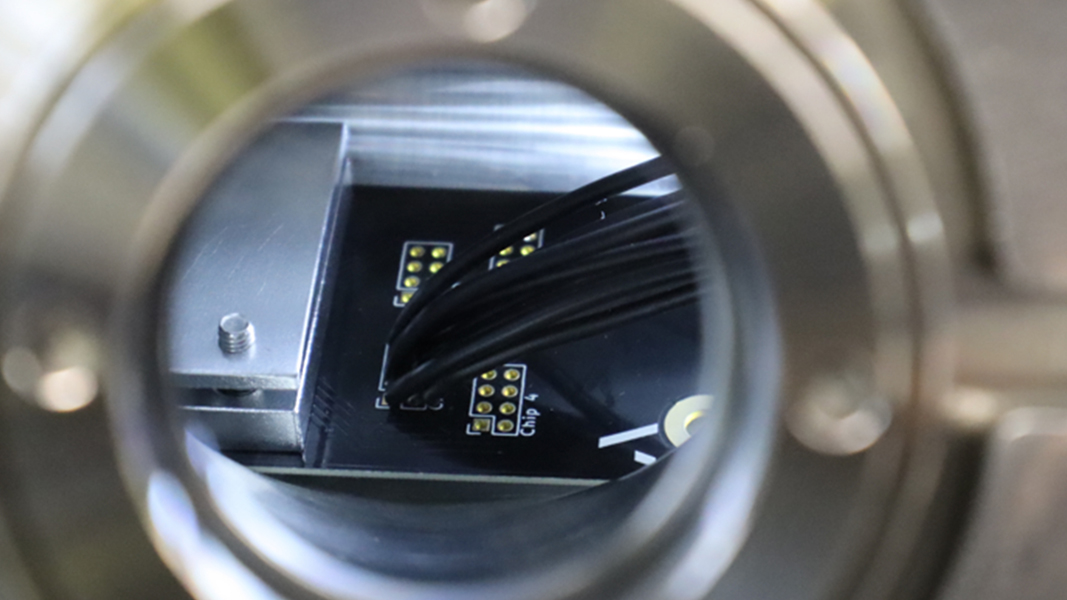

Instead, it expanded its capabilities. The Company has been establishing its own customised laboratory facility, with the core of the facility now operational and located at the Sydney Hardware Lab. It also joined the Academia-Industry Collaboration Program, which allowed Archer to have dedicated workspaces at the world-class Switzerland Innovation Park West École Polytechnique Fédérale de Lausanne (EPFL).

The Company has been collaborating with researchers at EPFL to develop second-generation integrated chip designs that allow for complex spin manipulation of Archer’s qubit material. The collaboration started in late 2022 and has been making significant progress since then.

“Archer’s establishment in Switzerland is of strategic importance to the Company’s international expansion. Switzerland represents the first logical step for international expansion given the Company’s existing relationship with EPFL and significant size of the European semiconductor, quantum computing and deep tech communities,” English noted.

Finally, Archer has been accepted as a customer by Taiwan’s TSMC, the largest semiconductor foundry in the world, which allows Archer to access TSMC’s advanced and mature semiconductor fabrication process technologies.

The semiconductor industry is currently valued at $825 billion worldwide and is set to revolutionise the way we live, with smartphones becoming smarter and healthcare becoming more advanced. Archer Materials’ unique technologies have the potential to play a significant role in this transformation.

- Ovanti’s iSentric signs contracts worth $14.4m with Malaysian commercial bank - June 27, 2024

- Baby Bunting fights back from retail downturn with 5-year strategy, includes Gen-Z focus and self-funded growth - June 27, 2024

- CLEO meets with US FDA to develop strategy for ovarian cancer test launch - June 26, 2024

Leave a Comment

You must be logged in to post a comment.