A client put a fair question to us this morning – will bank hybrid distribution payments come under threat as major banks start to reduce or defer dividends?

Bank dividends. As most investors by now appreciate, major Australian banks have (or are expected to) either reduce, defer or cut dividends on ordinary shares. National Australia Bank (NAB) reduced its interim dividend by approximately 65% to 30cps and Australia & New Zealand Bank (ANZ) deferred the payment of its interim dividend due to the uncertainty. Westpac Banking Corp (WBC) is expected to undertake similar measures when it reports its earnings.

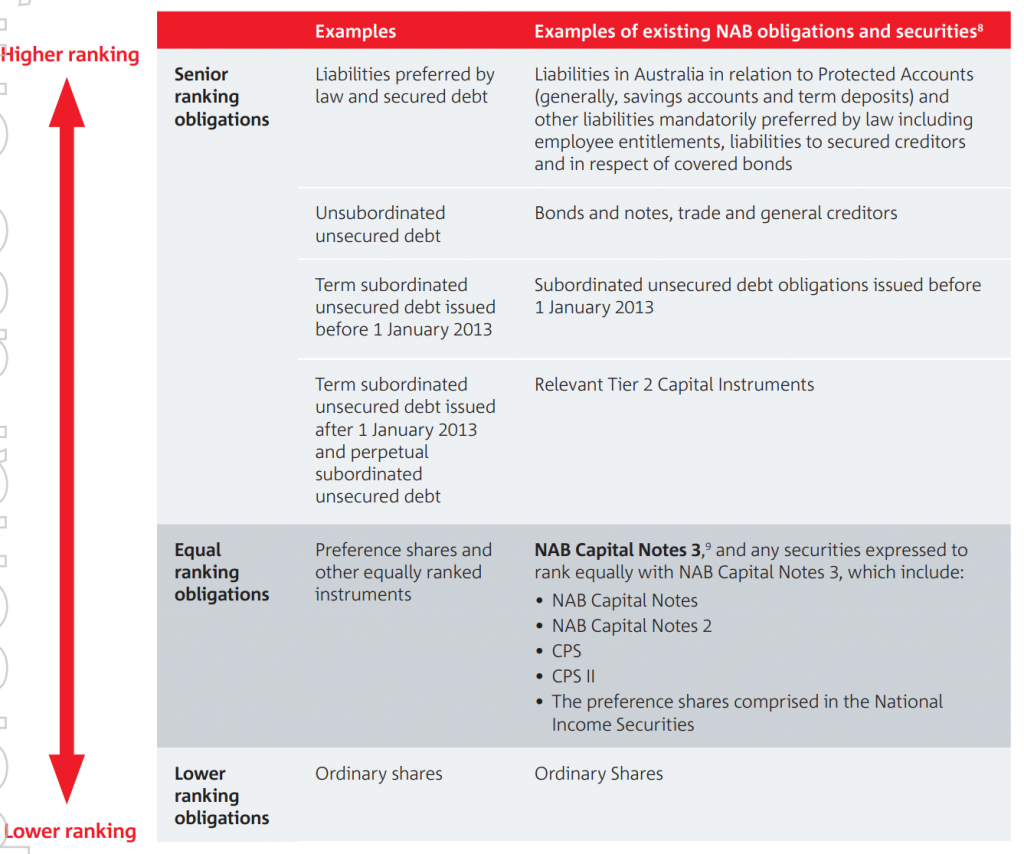

Bank hybrids. Banks not paying dividends in theory is a positive for securities up the capital structure, including hybrids (which sit one level above shares – NAB capital structure below). Deferred or reduced dividend payment on ordinary shares means the bank should see its capital position buffer improve and this should protect creditors up the capital structure. Dividends on ordinary shares are more discretionary than interest payments on hybrid securities.

Source: NAB

Hybrid distributions are also discretionary. Having said the above, it is worth highlighting that hybrid interest payments are also discretionary and are at the discretion of the board. Not paying distribution on a scheduled payment will not constitute a default as per the terms of most of these securities. But not paying a scheduled distribution on time on an outstanding hybrid would be a significant event and a decision to not pay distribution would be one the board would not take lightly, in our view. As it would likely see the bond value collapse. Simply because investors in hybrids/bonds rely on the interest payments as their main source of return (and likely used as income). Unlike equity holders, capital return is not the key driving factor for bond investors (of course you can still make money on capital if the bond trades at a premium). Further, if issuers are found to start cutting or delaying the interest payments on their hybrids/bonds, bond markets would cease up to these issuers in the future when they need to raise additional capital (or investors will seek a much higher margin as perceived risk has increased and this will increase the funding costs).

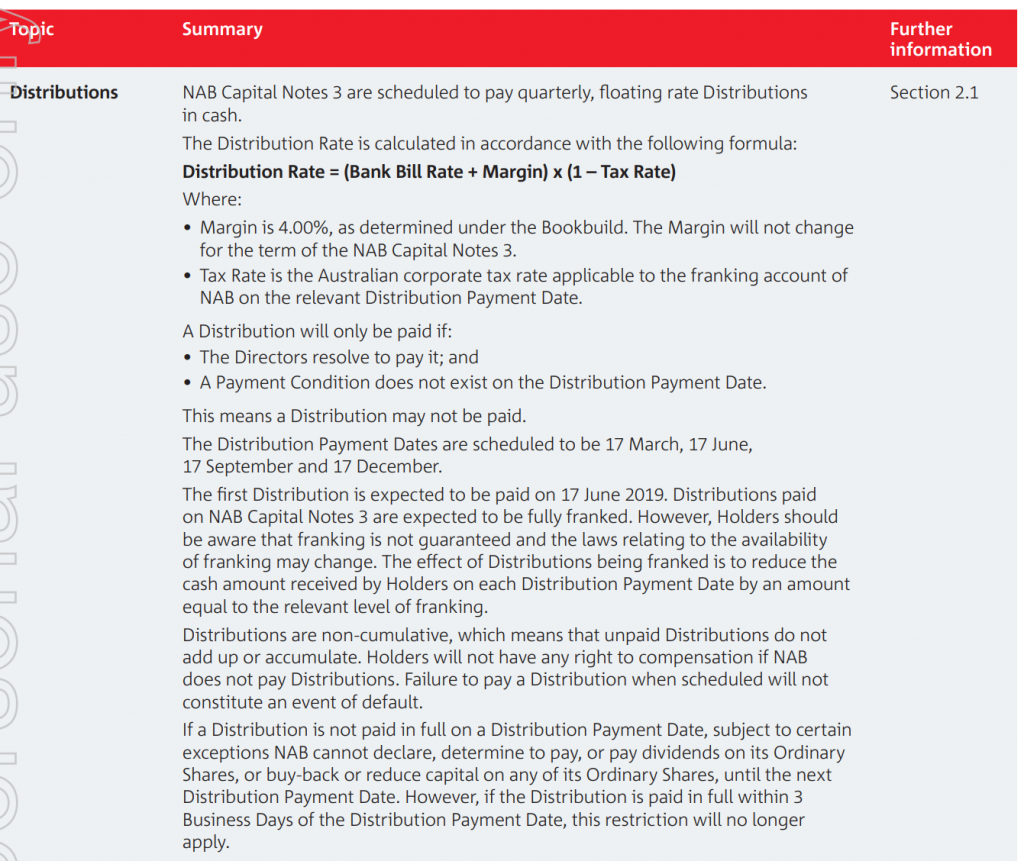

Dividend stopper clause. Most hybrids have a clause in their structure (see figure below – last paragraph) which states that if a scheduled distribution is not paid, then the bank cannot declare a ordinary dividend until the next distribution payment is made. So the fact NAB has declared a dividend at its recent result suggests they will have to maintain their payments on their hybrids.

Source: NAB

What about ANZ deferring dividend? We put the question to the ANZ CEO Shayne Elliot and CFO Michelle Jablko this morning on the analysts’ results briefing call – with ANZ deferring dividends, what was the board’s position on interest payments on hybrids. Management advise “the coupon payments on the hybrids, I think, stay as previously advised.” What is interesting is that NAB decided to declare a dividend but is also undertaking a dilutive capital raising of $3.5bn to increase its capital buffer – why not just defer dividend? ANZ has decided on a different course of action.

If banks across the board completely cut dividends and earnings/trading conditions still remain under pressure, then we would suggest interest payments on hybrids could come into question. They are discretionary after all. At this stage I do not think we are there.

Find out more about BanyanTree Investment Group, their research, and portfolios by clicking here.

- Quick Update: Who bought the dip?Iron ore update + more - August 14, 2024

- What if we are NOT in a new “commodities supercycle”? - August 1, 2024

- Who is going to power the AI boom? - May 30, 2024

Leave a Comment

You must be logged in to post a comment.