Sitting snug among companies with the largest market caps, from Apple to Amazon, Alphabet and more, US-based AI computing company Nvidia (NASDAQ: NVDA) makes a strong case for the growth of semiconductor companies worldwide. In 2022, global semiconductor sales reached US$963 billion, marking an increase of over 30% in just two years. And it is not set to stop there.

For the second quarter ended July 30, 2023, Nvidia reported a revenue of US$21.06 billion, up 101% from a year ago and up 88% from the previous quarter.

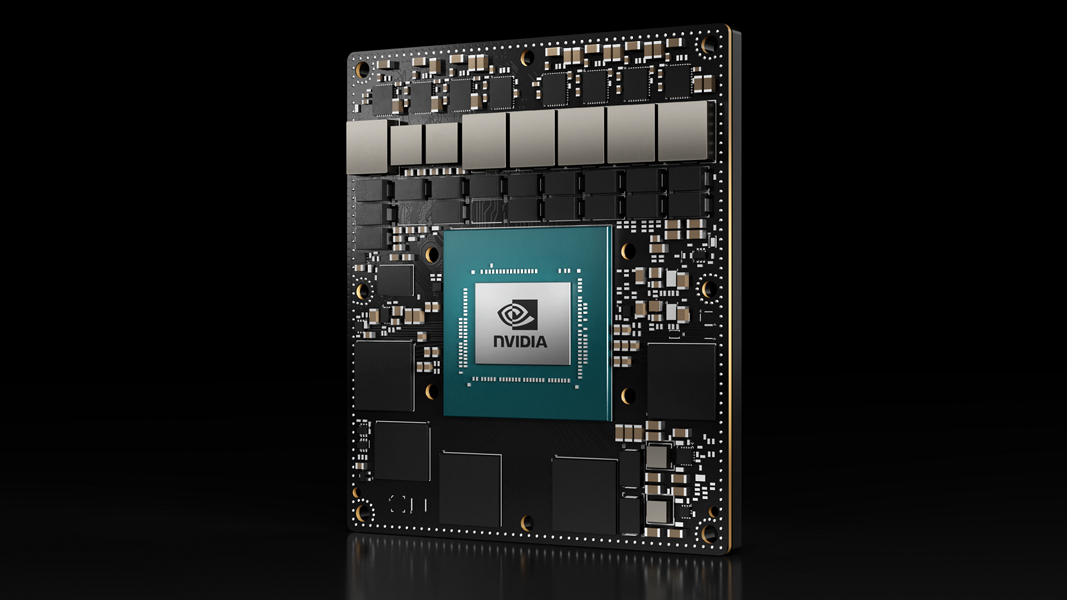

Founder and CEO of Nvidia, Jensen Huang, said, “A new computing era has begun. Companies worldwide are transitioning from general-purpose to accelerated computing and generative AI.”

During this quarter, Nvidia gave back US$5.27 billion to its shareholders. This was achieved by repurchasing 7.5 million shares for US$5.11 billion and distributing dividends in cash. By the end of the second quarter, the Company still had US$6.16 billion available for repurchasing shares as per its authorisation. On August 21, 2023, the Board of Directors sanctioned an unlimited extension for share repurchases, adding US$38.96 billion to the fund. Nvidia intends to persist with its share repurchase efforts throughout this fiscal year.

Huang added, “During the quarter, major cloud service providers announced massive Nvidia H100 AI infrastructures. Leading enterprise IT system and software providers announced partnerships to bring Nvidia AI to every industry. The race is on to adopt generative AI.”

For its data center division, revenue hit a record US$16.08 billion, up 141% from the previous quarter and up 171% from a year ago. The Company also informed that the Nvidia GH200 Grace Hopper Superchip, designed for intricate AI and HPC (high-performance computing) tasks, is currently being delivered. Additionally, a follow-up version of the superchip featuring HBM3e memory is projected to be shipped during the second quarter of the calendar year 2024.

In the third quarter, Nvidia expects revenue to be US$24.94 billion, plus or minus 2%. Nvidia will pay its next quarterly cash dividend of US$0.04 per share on September 28, 2023, to all shareholders of record on September 7, 2023

Investors are seeing Nvidia’s results as making a strong case for tech stocks, especially in the computing chip space. Closer to home, another fabless chipmaker, semiconductor company Archer Materials (ASX: AXE) has revealed itself as a top contender for the next generation of advanced processing devices. The Company is building a semiconductor chip—12CQ—a qubit processor for quantum computing that is being developed for potential use at room temperature. Archer’s development would expand the advanced form of computing to use cases in mobile devices and data centers.

In FY23, Archer started working with world-leading and tier-one semiconductor manufacturers, like TSMC (Taiwan Semiconductor Manufacturing Company), to bring its technology to life. It also teamed up with the World Economic Forum’s Centre for the Fourth Industrial Revolution as Australia’s first industry representative. Plus, it spent about $3 million dedicated on research for its various chip technology development.

The Company’s operating expenses improved from over $4 million cash used in FY22 to about $3 million in FY23. It ended the year with A$23.3 million cash, most of which was held in short-term deposits to leverage the total cash on their balance sheet for earnings from interest.

With its sights set on securing commercial partners and wafer production of its technology in FY24, Archer is determined to make Australia a key player in the semiconductor space, and to set in place the hallmarks of a global semiconductor enterprise with aspirations drawn from NVIDIA’s metric rise in the US over the past 30 years.

Emerald Financial has published a detailed report covering semiconductor companies listed on the ASX. Register below to receive the full report.

- Ovanti’s iSentric signs contracts worth $14.4m with Malaysian commercial bank - June 27, 2024

- Baby Bunting fights back from retail downturn with 5-year strategy, includes Gen-Z focus and self-funded growth - June 27, 2024

- CLEO meets with US FDA to develop strategy for ovarian cancer test launch - June 26, 2024

Leave a Comment

You must be logged in to post a comment.