Given so many coronavirus experts have appeared since its outbreak, we haven’t felt the need to add to the noise. But we have been closely monitoring the situation through macro data, bottom up company research, discussions with company management teams, with our partners here and offshore. The recent offshore and current ASX reporting season has also been very timely to get a pulse check on where guidance and outlook sits. A reporting season wrap will be provided to clients.

We have been providing some updates on our LinkedIn page periodically with respect to the number of new cases and deaths etc (feel free to follow us).

Frankly, no one (including those who claim to) has any idea how bad the situation is or likely to get before it improves. Invariably, things will and should improve and I am sure everyone on this email has heard it – “watch for the new cases to start declining”. Efficacy of data is one concern of ours. The debate on whether it is a V shaped recovery or U-shaped is not necessarily our focus at this point, our concerns rest with the fact whether the disruption in trade sets off other unintended consequences.

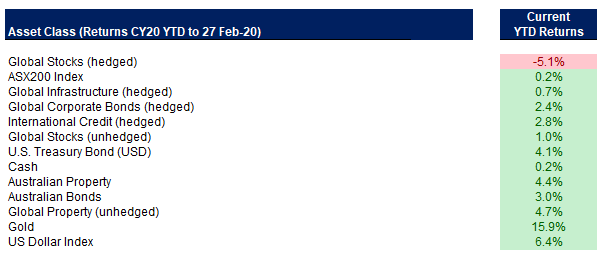

Quick pulse check across assets classes. CY20 YTD returns to 27 Feb-20 are provided in the table below. This clearly does not include today’s movement (28th Feb, the ASX is currently down -3.1%). Bonds and Gold have done well. In our recent Multi-Asset Quarterly Report we noted the following – “The likelihood of a significant market sell-off is high, in our view. In this case, gold will likely play a key role in portfolios as both bonds and equities valuations remain elevated.”

Source: Bloomberg, Banyantree. For each asset class we use a low cost ETF to represent the performance.

Our cash levels across our portfolios were already elevated. Tactically (TAA Multi-Asset Strategy), we moved to a more defensive position with our asset allocation (i.e. increasing cash and retaining our duration exposure) in October 2019. We also increased cash across our Strategic Asset Allocation (SAA) risk profiles. Heading into CY20, in our recent Multi-Asset Quarterly Report we noted –

“the onset of Coronavirus out of China will likely see risky assets struggle to outperform in the short-term whilst the global threat remains dynamic. In any case, there will be an economic impact to Chinese GDP and global growth (especially given it is during the important Chinese New Year period). However, the experience of similar outbreaks (e.g. SARS in 2002) suggest economic activity (and risky assets) do bounce back once the threat is contained (too early to call this). However, we would caution against using the SARS experience as template for coronavirus as the world is a much different place compared to 2002.”

The situation with Coronavirus has materially deteriorated since our report was published, making our call on duration (current position in U.S. Treasury up +11.1% YTD with positive currency impact) and elevated cash levels the right call. Both were out of consensus calls in our view. Whilst we may have given up some gains at the back end CY19 and early CY20 to equities, clearly this is playing in our favour now.

Banyantree Equity Strategies. Similarly, our Australian Small Companies strategy (available to clients on Hub24 and Powerwrap) is significantly outperforming its benchmark by over +400bps month-to-date in Feb-20 (YTD it is up +3.7% vs. Benchmark -1.53%). Our Australian Core Strategy is mostly flat CY20 YTD (-0.33% vs benchmark -1.53%). We do not manage portfolios relative to benchmarks, they are provided just a reference for clients. Elevated cash levels hurt performance last year (especially Small Caps strategy which had close to 15% in cash), however persisting with cash levels into CY20 where valuations were elevated + earnings outlook looked Ok is paying off. There are a number of companies which we have been following that now look like good value.

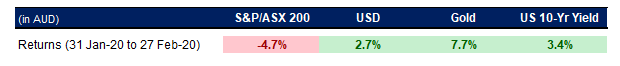

But you just said bond valuations were already elevated and yet you kept your duration call on – how does that work? Our downside risk hedge has been via plain and vanilla duration within our TAA heading into CY20, despite duration delivering one of the best returns last year (which we picked up all of given we introduced duration to our portfolios at the start of 2019). Granted duration call was a much riskier proposition at the start of this year – all economic indicators were showing greenshoots. However, equity valuations were very elevated at the start of this year and heading into the reporting season, we felt there was more downside risk to earnings. Plus Coronavirus at that time was an unknown quantity (very much in just Wuhan China). We preferred to keep our hedges on and analysis shows in times of flight to safety U.S. Treasuries and U.S. dollar are still your best way to play safe havens along with gold. This again has been proven correct in Feb-20 – see table below with equities (using U.S. as a proxy vs other safe havens).

Source: Bloomberg, Banyantree

Where to from here:

(1) Monetary policy support. Yes you will likely get more efforts from central banks (Fed could cut rates and RBA is likely to go at least once), but this is not a liquidity crunch as such. Cities (and businesses) are shutting down in order to contain the virus not because there isn’t enough liquidity. Nonetheless it should help market sentiment.

(2) Fiscal policy support. We expect more to happen on this front globally. Even Australian PM Scott Morrison, who has resisted calls to use the balance sheet, has flagged it. Government implementations can be slow and not necessarily methodical. Nonetheless we think this is important and positive move.

(3) We are looking to deploy cash. Market is now in a mini correction (more than -5% decline) and corrections can be as much as -20% (before a bear market takes hold – which typically requires a recession). At this stage it looks as though it may be a buying opportunity – especially investments which were previously trading at elevated multiples. But just buying the dip is dangerous, in our view. We prefer to await economic data to get a better handle on what is actually flowing through versus anecdotal accounts.

(4) Liquidity in portfolios. In our discussions with various industry participants, it appears complacency on liquidity is starting to appear again (even before Coronavirus). Clearly, Alternatives is one area where liquidity concerns are elevated. However, even listed stocks may see liquidity dry up in extreme market conditions. We have seen clients gravitate towards Alternative assets – reduces volatility (which is easy because you don’t mark-to-market every day!), provides good income (which is a struggle in a low rate environment) and low correlation returns to other asset classes.

We have resisted adding any Alternatives to our SAA models because of the liquidity concerns. The Alternatives in our TAA model are playing very specific themes and are equities focused. The fine print on a lot of these Alternative investments may surprise a few investors. Managing family office money during the GFC taught me a very valuable lesson about liquidity – I need liquidity when everything is down by 20-30% so we can go shopping rather than be locked up in structures where we cannot withdraw capital (even if these structures did provide you the downside protection in an extreme market sell-off – wouldn’t the objective at that point be to liquidate these real assets giving your CPI + margin type returns and to move into equities which can provide you 20-30% upside?).

Obviously, I have over simplied the situation but having liquidity is important – and it should not come at any cost (selling $1 asset for 10cents is not liquidity). The key takeaway is that I would be cautious in locking away 40-60% of you portfolio in Alternatives (caveat not all alternative are bad!), where frankly the liquidity is a little vague. This is not to say we wouldn’t consider illiquid investments – as long as they make sense and we manage our exposure. However, if I have invested in a real asset the last thing I would want is my real asset being liquidating at precisely the wrong time. Hence, our approach to such investment is investors should expect capital to lock up in extreme market conditions. Complex structures are not a sign of better investments.

Find out more about BanyanTree Investment Group, their research, and portfolios by clicking here.

- Quick Update: Who bought the dip?Iron ore update + more - August 14, 2024

- What if we are NOT in a new “commodities supercycle”? - August 1, 2024

- Who is going to power the AI boom? - May 30, 2024

Leave a Comment

You must be logged in to post a comment.