The legend that is Warren Buffet is entrenched into the psyche of the investment world. Listening to his presentations over the years demonstrated a wisdom to distil the most complicated investment topic into a down-to-earth homespun explanation, that never ceased to amaze. His mantel as teacher and guru will persist long into the future.

His philosophy of investing into the share market was explained: imagine if you owned a farm and you also had neighbours that similarly owned farms. Those neighbours do you the courtesy of valuing your farm every day, offering to purchase your property at what they perceived as fair value. You do not have to accept their offer and you just get about your business of running the farm. Similarly, they offer to sell their properties to you. You have your perception of what their farm is worth, and as the prices fluctuate, you can pick up a bargain.

Warren Buffet purchased Berkshire Hathaway in 1962, with the first few decades establishing his reputation for delivering outstanding returns. For example, from 1976 to 1979, Berkshire delivered a 680% return compared to the SP500 index return of 44%.

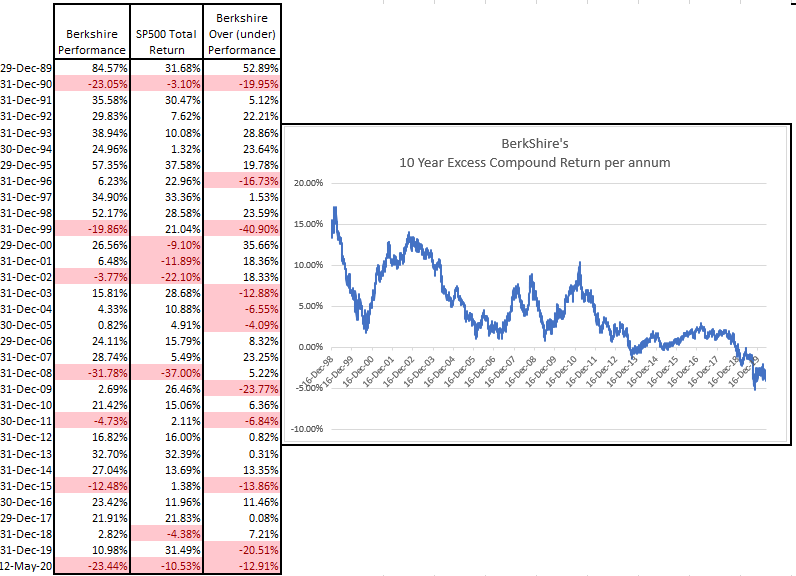

The chart below shows that over time, particularly in the last ten years, the outperformance has declined. Consistently beating the index performance over a 10 year period is still quite an achievement, but the heady days are long gone. Unfortunately, over the past year and a half, Berkshire’s performance against the index has moved firmly into the negative for the first time.

Last year’s performance of nearly 11% compared poorly to the SP500 return of 31%. Since the start of 2020, Berkshire has underperformed by nearly 13%.

Berkshire currently has a market capitalisation of $420 Billion (more than 25% of Australia’s top 200 shares). The company holds $125 Billion in cash and underscores its financial strength and ability to ride out a market storm. But it may be seen to be an elephant in the room and its ability to deploy that amount of cash successfully, may prove to be elusive.

To use Warren Buffet’s analogy, Berkshire has one of the biggest farms in the country and it needs to buy another big farm to make an impact on the potential performance of the business. It is much easier to add value when you are small.

- How the Chevron Doctrine decision could shake the environment and investors - July 10, 2024

- Why a tsunami of liquidity might be on its way - July 5, 2024

- A quick explainer on Hybrids and why people trade them - June 24, 2024

Leave a Comment

You must be logged in to post a comment.