CSR Limited

CSR Limited (ASX: CSR) this morning has reported a 10 percent drop in statutory NPAT from continuing operations and a 5 percent drop in revenue.

CSR stated that this reflected a slow-down in residential construction. Statutory NPAT was up strongly, which reflected a loss from discontinued operations in the previous period.

The business will not pay a final dividend for this year and they have paused the share buyback; which while not great for shareholders in the short-term, increases the cash assets of the business.

The Chairman of CSR described the results as ‘solid’ in the annual report although he also described the current market conditions as ‘challenging’.

While the results are down on the prior period, they look fairly good in relation to analysts estimates, except for the lack of dividend, which could dent investor sentiment.

Macquarie Group

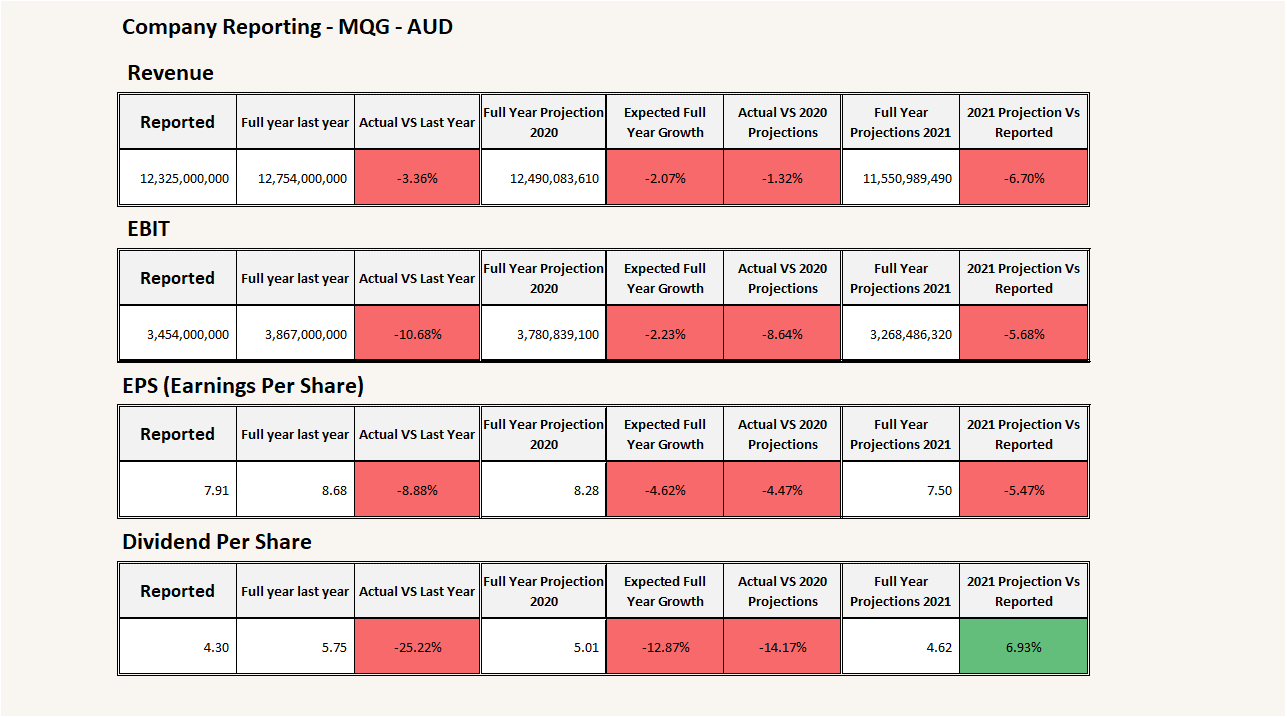

Last Friday Macquarie Group reported its full year earnings for 2020, with profits declining 8 percent to $2,731 Bn; an earnings per share of around $7.91.

They will also pay a $1.80 dividend on the 11th of May, which will be funded entirely by the non-bank group. Earnings took a hit from credit and impairment provisions and charges and a reduction in merger and acquisition activity.

The bank stated that conditions are likely to remain challenging and that its unable to provide meaningful guidance for 2021.

The result looks quite good in comparison to the major domestic banks. We expect it to perform quite well moving into its dividend, which will be paid on Monday the 18th of May.

Want more equity research like this?

Emerald Equity Research is an upcoming investing platform providing all the data and insights to keep you well informed on stocks and the wider economy.

The platform gives you access to a trove of stock data and research, including;

- Extensive fundamental data

- Stock recommendations

- Charting

- Unique quantitative ranking

- Stock screeners and custom reports

- Daily news

- Market views

- Dedicated weekly equities webcast

Click here to register for the upcoming Free Beta Trial.

- XJO to rise despite slight US pullback - August 30, 2024

- Markets jump strongly higher - July 29, 2024

- US shares drop with tech selling, XJO to continue lower - July 25, 2024

Leave a Comment

You must be logged in to post a comment.