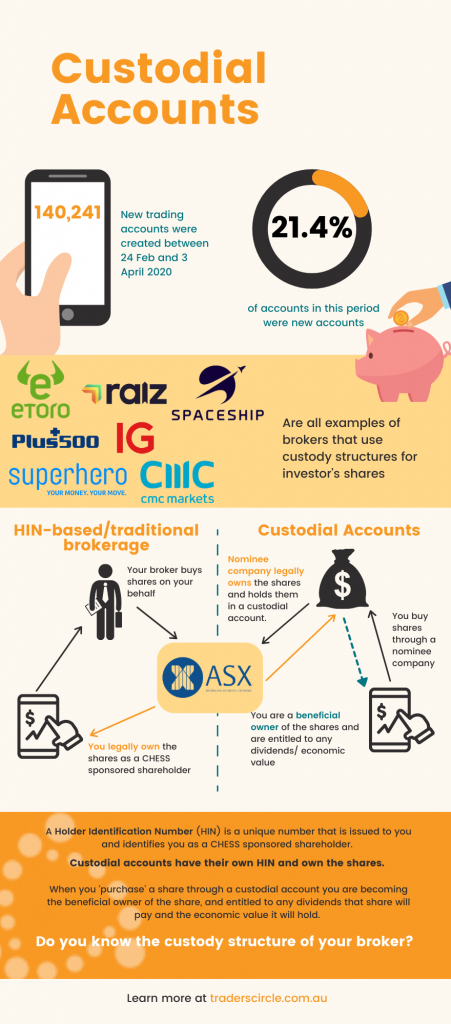

The global pandemic affected almost every aspect of modern life, and the stock market was no exception. The stock market crash early in 2020 saw an influx of retail investors and a huge increase in the number of accounts opened on trading apps. While investing is almost always a positive step towards financial freedom, experts are concerned that inexperienced retail investors are flocking to apps without fully understanding their custody structure and risk involved.

What is a custodial account?

Simply put, a custodial account is a brokerage account with a nominee company for investing in shares. You don’t technically own the shares you invest in. The nominee company (or custodian) holds securities in their own name, on behalf of the actual investors.

Custodians can organise dividend and interest payment collection and distribution, transaction processing, tax reporting and brokerage account administration.

Wait, what do you mean I don’t own the shares?

When you buy shares through a traditional broker, you receive a Holder Identification Number (HIN) that is registered with the stock exchange registry. You own these shares directly in your name. Custodial accounts have their own HIN and own the shares. When you ‘purchase’ a share through a custodial account you are becoming the beneficial owner of the share, and entitled to any dividends that share will pay and the economic value it will hold.

Ok, so what’s the catch with custodial accounts?

Not owning your shares directly can open you up to another layer of risk. If the nominee company that holds your shares goes bankrupt or ceases to exist for some reason you will have to compete with others who have a claim to the nominee company’s assets, their shares. By trading through a nominee company you are assuming this risk with a counterparty.

What might happen if a nominee company goes broke?

In 2011, following the global financial crisis, major brokerage firm MF Global went bankrupt. Customer losses were as high as $1.6 billion. Two years after liquidation the company was approved for settlement that would return only 93% of their customers’ investments.

Only 93%.

Customers had to wait years to access their hard earned money and even then, couldn’t access all of it.

Other examples of pooled assets in custodial structures to fail were Sonray in 2011 (Shares, CFDs – $47m loss), Halifax in 2019 (Shares, CFDs – approx $33m loss), BBY Stockbroker in 2015 (Shares, Derivatives, CFDs – approx $40m loss). Interestingly, the trustee of Halifax’s preferential shares, Australian Executor Trustees (AET), was owned by IOOF. AET was sold to Sargon Capital Pty Ltd, with the Sargon Group entities collapsing in January 2020.

Are there any benefits to custodial accounts?

Yes! Nominee companies pool investors money together which means that they can offer cheaper brokerage fees than traditional stock brokers.

Some nominee companies also give investors the option of fractionalising a share, meaning investors are able to diversify their portfolios and access stocks they may otherwise be unable to afford. Foreign share markets are also available through most custodial accounts in Australia.

How do I check my broker’s custody structure?

Brokers will provide details on their custody structure in a Product Disclosure Statement and their Financial Services Guide, these are usually available via their website.

Final thoughts

Whether you use a HIN or custodial account is of course, up to you and your level of risk tolerance. Longer term investors managing a large portfolio tend to ensure they directly own their shares via a HIN, whilst day traders making frequent trades tend to prefer the cheaper offering of a custodial account.

Something you hear a lot in this industry is the phrase ‘you get what you pay for’ and that’s definitely the case here. The peace of mind that your capital is safe can be worth more than super cheap $5 brokerage.

Check out the infographic below for more info around the rise of retail investors and use of custodial accounts. Find out more about TradersCircle’s trading and stock market education services by clicking here.

- Parkinson’s UK backs Pharmaxis with $5 million to slow the onset of incurable disease with ‘ground breaking’ trial - September 1, 2022

- How this company is developing medtech to support Indigenous community health - August 22, 2022

- A round of ap-paws for PharmAust, changing the ruff prognosis for dogs with lymphoma - August 17, 2022

Leave a Comment

You must be logged in to post a comment.