Energy markets are grappling with tensions between Russia and Saudi Arabia, with a price war emerging post recent OPEC+Russia meeting. ASX energy sector sold off yesterday as a result.

Energy valuation summary (prices as of end of day yesterday

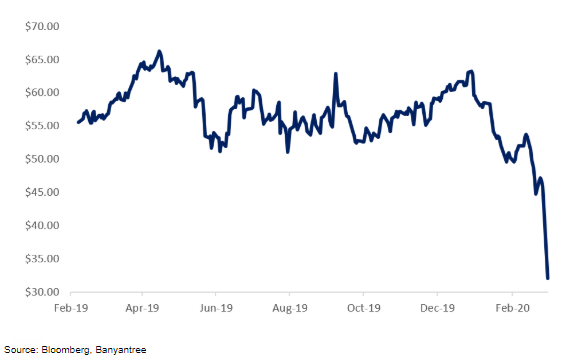

OPEC+Russia delivers a nasty surprise. Most investors were holding out on the hope that the recent OPEC+Russia meeting will see the block of oil producing nations agree on deeper production cuts to support oil prices as demand is likely to take a significant hit due to the disruption caused by the Coronavirus. However, investors were left blindsided when negotiations between the two key players – Russia and Saudi Arabia – broke down. It was reported that Russia did not agree to any production cuts and subsequent to this meeting Saudi Arabia offered its crude at significantly discounted prices in Europe, Asia and Europe. Further, Saudi Arabia noted its intention of increasing production levels, with reports also suggesting Russia will not hold back its companies from increasing production. Effectively, Saudi Arabia has launched a price war. As the chart below highlights, this led to the oil price collapsing more than 30%.

There are several implications for consideration, which we discuss below:

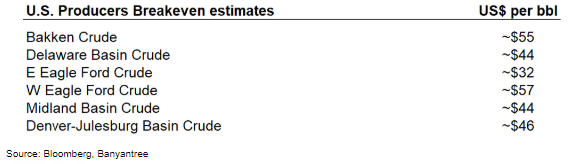

Russia. It was reported that Russia refused Saudi Arabia’s suggestion of deeper cuts to put a floor in oil prices. Russia’s refusal could be seen as a tactical play at hurting U.S. shale producers who have benefited from higher oil prices and production in recent years. Oil price at current levels will likely make many of the U.S. shale producers loss making and will also limit their ability to get financing. However, we note that OPEC has in the past tried to hurt U.S. shale producers with lower oil prices, but the sector was able to come through by being more efficient. Further, there are suggestions Saudi Arabia is trying to shock oil markets in the hope it will drive Russia back to the negotiation table. However, Russia can sustain lower oil prices for much longer than Saudi Arabia and some of the other Gulf nations.

Saudi Arabia. Saudi Arabia is the lowest cost producer in the world – less than US$5/bbl. However, Saudi Arabia’s budget breakeven oil price is US$83.60/bbl versus Russia at US$42/bbl and significantly higher than U.S. shale producers. Lower oil prices hurt Saudi Arabia at a time when it is trying to make significant investments in other parts of its economy to reduce its exposure to oil.

Lower oil prices not necessarily good for the U.S.Lower oil prices in the past has been a positive for the U.S. consumer. However, the current situation is such that any likely demand pick-up from lower oil price will be relatively contained due to the demand destruction from the Coronavirus. From a political perspective, the hit to employment – both directly employed by the U.S. shale industry plus contractors & suppliers to shale oil projects (that is, reduced or discontinued capital expenditure plans) – could be key in the upcoming U.S. election. The breakeven price for U.S. Permian basin producers is also at similar levels to Russia at US$42/bbl. However, unlike sovereigns, companies cannot run budget deficits and credit markets could seize up if the oil price stays below these levels for an extended period of time.

U.S. oil exports have also significantly increased in recent years. Consequently, lower oil prices also hurts U.S. companies. According to data from the EIA (Energy Information Administration), total exports of U.S. oil and products has increased to 8.9 million barrels per day in Oct-19 from 6.5 million barrels in January 2018. Approximately 25% is sent to Mexico & Canada, ~20% for South Korea, India and Japan, and ~3% for China (pre trade wars).

Global oil majors. A sustained period of lower oil prices will impact cash flows and could bring into question the sustainability of dividends and balance sheets in the near-term. Further, main large oil majors such a Royal Dutch Shell Plc have called out long-term strategies of becoming more sustainable. This requires heavy investment and should cash flows take a hit from lower oil prices, the attention will turn to debt and dividend management rather than executing long-term strategic agenda.

Implication for Australian oil companies. Much like their global counterparts, lower oil prices are not good for Australian oil companies Woodside (WPL), Oil Search (OSH), Santos (STO) and Beach Energy (BPT). The breakeven price for these companies is low-to-mid US$30s per barrel. However, the bigger issue is that new projects coming up for FID (final investment decision) will require the oil price at much higher levels. This could see the boards of these companies shelf some growth projects. High leverage could also be an issue should oil prices stay lower for longer. Beach Energy (BPT) and Cooper Energy (COE) are more exposed to gas, whilst WPL, OSH and STO are most leveraged to the movement in oil prices.

Find out more about BanyanTree Investment Group, their research, and portfolios by clicking here.

- Quick Update: Who bought the dip?Iron ore update + more - August 14, 2024

- What if we are NOT in a new “commodities supercycle”? - August 1, 2024

- Who is going to power the AI boom? - May 30, 2024

Leave a Comment

You must be logged in to post a comment.