I wanted to share a worthwhile article from our colleague arguing for investors to take the lead on climate change through allocation rather than wait for government intervention (who appear paralysed to an extent on this issue). Attached for your convenience and also available on our LinkedIn page.

Additionally, I wanted to provide an example of a thematic and a stock within our ESG (Environmenal, Social, and Governance) universe which passes all our ESG screens. Again worth highlighting our ESG screens also include additional sustainability screens which, to the best of our knowledge, is not a consideration for most ESG managers.

Please get in touch for more information on our recently introduced ESG capability or any of our other core strategies (Global Core Equity, Australia Core Equity, Australia Small Companies and Multi-Asset Strategies)

GHG framework

Humans and businesses emit greenhouse gasses (GHG) into the atmosphere, with practices such as burning fossil fuels like coal, natural gas and oil. The situation is further exacerbated by the fact that humans are also reducing the number of trees (e.g. through urbanization) which absorb CO2 in the atmosphere, effectively removing one component of the ecosystem which helps maintain the equilibrium. The side effect of GHG is that it leads to higher global temperatures. Hence, why the argument on this topic is termed climate change.

In order to assess a company’s carbon footprint, investors need to develop an analytical framework which covers the full value chain. Emissions can be framed in 3 categories (we note there is also Scope 4 but we will focus on 1, 2 & 3):

* Scope 1: Direct emissions. Directly related to a company’s activities under management’s control (e.g. fuel combustion at manufacturing plants).

* Scope 2: Indirect emissions. Activities not directly undertaken by a company but contribute to their operations (e.g. purchasing electricity for consumption).

* Scope 3: All other indirect emissions. Depending on the business model, Scope 3 can make up the largest component of a company’s carbon footprint. This scope includes emissions coming from sources not controlled or owned by a company (upstream and downstream activities). For example, car manufacturers sell cars to consumers, who then emit emissions from the use of these cars over many years.

Thematic – Sustainable Transport Solutions

Railroads are estimated to be 4 times more fuel efficient than trucks. Hence, it makes sense leveraging rail for long haul, whilst utilising trucks for shorter distances. The effective use of rail will reduce GHG emissions and therefore work towards an environmentally sustainable future. Given its efficient and environmentally friendly way to transport goods, in our view, rail has the potential to play a significant part in reducing the environmental impact by providing sustainable transportation solutions. ethical

Thematic Stock: Canada National Rail (CNR)

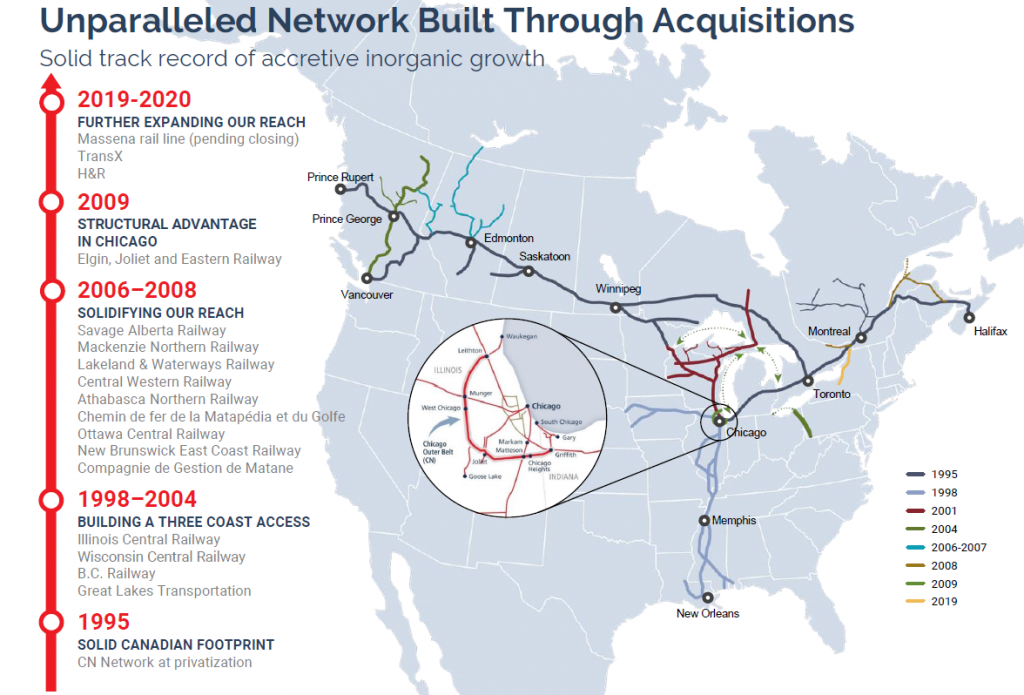

CNR operates a network of tracks in Canada and the U.S. CNR transport forest products, grain and grain products, sulfur, intermodal and automotive products. CNR is Canada’s #1 railroad and one of the largest in North America. The Company operates difficult to replicate (high barriers to entry) and critical infrastructure which supports the economy and trade movement.

Source: Company

CNR has a target of 29% GHG emission intensity reduction by 2030 with 2015 as its base year. The Company generates ~90% of its direct GHG emissions from rail operations and is therefore its main focus. CNR low carbon transition plan includes the following focus areas:

(1) Fleet renewal. Which includes the purchase of new locomotives with GE Transportation’s GoLINC Platform, Trip Optimiser system and Distributed Power LOCOTROL eXpanded Architecture to maximise train effectiveness and efficiency.

(2) Fuel-efficient technologies and data analytics. Continue to invest in technology which helps optimise fuel efficiencies and data analytics to improve the overall efficiency of CNR’s fleet.

(3) Fuel conservation practices. Implementing best practices for fuel conservation, including locomotive shutdowns in our yards, streamlined railcar handling, train pacing, coasting and braking strategies. We are also training our locomotive engineers on-the-job on technologies to optimize fuel consumption.

(4) Renewable Fuels. To further reduce our emissions by using renewable fuel blends in our locomotive fleet. As part of our plan, we will be focusing our efforts on working with our suppliers to explore the use of renewable fuels as an important part of how we meet our regulatory compliance obligations and efficiency objectives in line with our science based target.

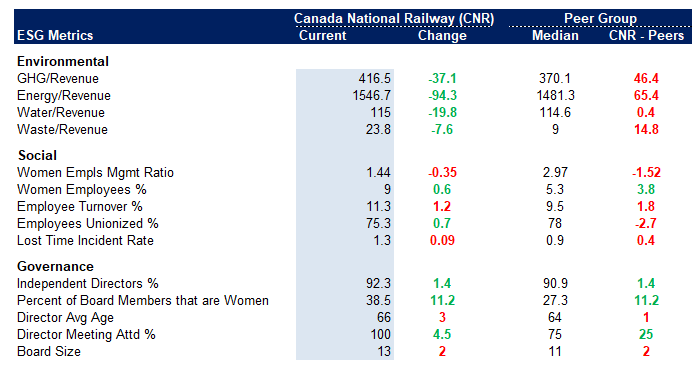

CNR ESG metrics. In the table below key ESG metrics for CNR are provided, along with a benchmark against a peer group. Green represents improvement on previous Company reading (i.e. positive improving trend) or better than peer. Red means deterioration on previous reading or lagging peer group.

CNR has continued to make inroads into E and G metrics. However, the Company still has improvements to make in S and lags Peer group metrics, especially in E. In our view, this is where the opportunity is and represents upside. This also highlights an important point on how we are approaching ESG investing and alpha generation. That is, investors are more likely to derive better returns from investments which have improving ESG trends versus investments which represent little upside given they already score very high on all ESG metrics. It is akin to finding a company trading on a cheap valuation but has a strategy in place which could see the stock re-rating higher over future periods versus buying the best quality Company in the sector which already trades on high multiples and represents little upside given all the good news is “already in the price”.

- Quick Update: Who bought the dip?Iron ore update + more - August 14, 2024

- What if we are NOT in a new “commodities supercycle”? - August 1, 2024

- Who is going to power the AI boom? - May 30, 2024

Leave a Comment

You must be logged in to post a comment.