If there was one extra house built for every so-called expert out there offering up solutions to Australia’s seemingly intractable housing crisis, the problem would be solved.

Oftentimes, these solutions entail supply side initiatives that will supposedly see the number of dwellings available for sale expand to growing demand. But simply saying that a ‘build, baby, build’ approach will eliminate the current supply/demand imbalance evident in Australia’s housing sector fails to adequately address the complexity of this problem.

Sure, freeing up more land for residential development and approving more medium and high density housing in cities like Sydney, Melbourne and Brisbane where dwellings available for sale or rent are too low would help.

But even if this were to occur, it would still not solve another roadblock to housing construction that is exacerbating Australia’s ongoing housing demand/supply imbalance, which is a steady incline in the cost of building dwellings.

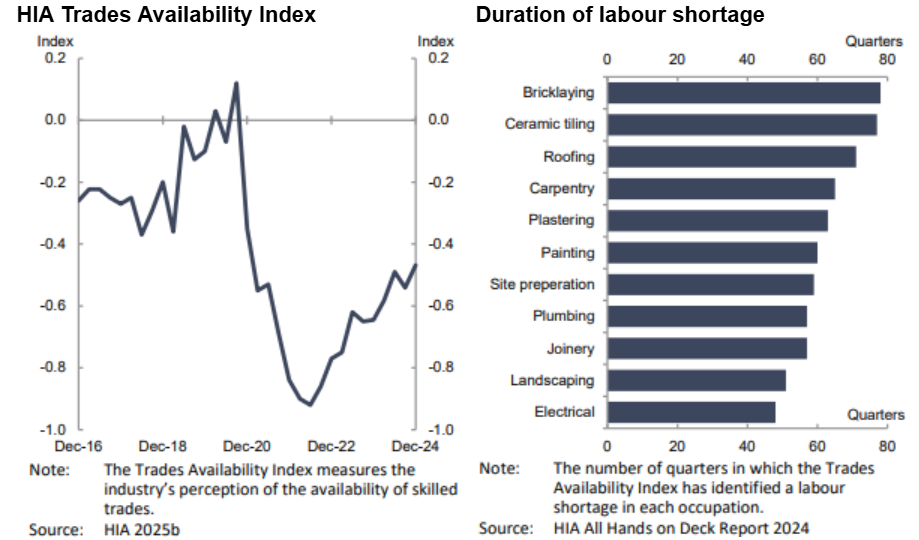

While there are many factors behind the inexorable rise in the cost of building housing stock on construction-ready development sites over recent years, one that is today getting plenty of airplay is the ongoing shortage of skilled tradesmen shortages. These workers have skills that are demanded by builders across all parts of broader construction sector – and that includes the not insignificant renovations segment of the housing sector.

The magnitude of this ‘tradie’ shortage issue was examined in detail in the latest annual State of the Housing System 2025 report prepared by the National Housing Supply and Affordability Council (NHSAC) (Link: https://nhsac.gov.au/reports-and-submissions/state-housing-system-2025).

It contains two insightful charts, that clearly show the trader shortage that is now confronting builders across Australia. Note the clear message in the second chart – namely that bricklayers are particularly in short supply

Source: National Housing Supply and Affordability Council State of the Housing System 2025

But now technology platforms have started to emerge that could realistically rein in the labour costs associated with the construction process itself – the latter in the form of automation or robotics.

ASX-listed FBR Limited (ASX:FBR) is one company with such a technology platform. Importantly, this platform, and the Hadrian X® product evolving from it, is now successfully penetrating the US and Australian housing construction sectors.

FBR’s Hadrian X® robotic product is the world’s first mobile (highway capable) robotic block-laying machine and system, able to work safely outdoors in uncontrolled environments with speed and accuracy. It builds block structures from a 3D Computer-Aided Design model, producing far less waste than traditional construction methods while dramatically improving site safety.

Hadrian X®‘s shuttle block-delivery system handles blocks up to 600mm x 400mm x 300mm or 23 Standard Brick Equivalents, weighing up to 45 kgs, with scope for other industry applications. It is capable of building the walls of a house in situ in as little as a day. The Hadrian X® provides Wall as a Service®, FBR’s unique commercial offering, to builders on demand.

In June 2025, FBR announced to the market that it had executed a non-binding Memorandum of Understanding with Northern Territory builder Habitat (NT) Pty Ltd for the sale of Hadrian X® units under a Machine Supply Agreement. In addition to supply of an initial Hadrian X unit, will also be able to provide Habitat with operating and maintenance training, remote IT, operating/maintenance support and licensed access to all ancillary software.

In the United States, FBR has continued to progress discussions with third party financiers regarding potential funding options for deploying Hadrian X® units. The latter country has one of the largest low-rise residential construction markets in the world.

The Hadrian X® machine utilises FBR’s Dynamic Stabilisation Technology™, or DST® for short, which corrects for dynamic interference and vibration in the boom and layhead in real-time, and places blocks with precision. If effectively allows Hadrian to work with precision in outdoor environments.

FBR has recently moved to strengthen its balance sheet via some funding initiatives. Some of the new equity received from these initiatives will provide funding for FBR’s plans to complete commissioning of a further Hadrian X® robot and the development of new DST®-enabled products.

So, while FBR’s Hadrian X® does not offer an all encompassing solution to the current demand/supply imbalance in Australian housing market, it does at least offer a one way to take some of the heat out of cost pressures associated with building the dwellings demanded by Australian owner occupiers, renters and investors.

- FBR’s tech could help reduce housing construction-related cost pressures - August 21, 2025

- June 2025 quarter CPI no roadblock to August RBA rate cut - July 31, 2025

- Australia’s GDP inches higher in March 2025 quarter - June 5, 2025

Leave a Comment

You must be logged in to post a comment.