As the world emerges from a pandemic, Australians are proving to be more conscious of their general health than ever as evidenced by allied health company Healthia (ASX: HLA) which has delivered shareholders a 91% increase in underlying EBITDA.

The bumper result was driven by 14.5% organic growth across the Group whose clinics continue to realise cost optimisations from Healthia’s supply chain network, as well as cross-referral opportunities between their podiatry, physiotherapy and optometry clinics.

“The strong organic growth achieved is testament to their ongoing dedication and resilience. The results are also reflective of the essential nature of the allied health services that our businesses and people provide to their local communities” said Healthia CEO, Wesley Coote.

“As we continue integrating Healthia’s new Eyes and Ears division (settled 30 November 2020) into our allied health network, we look forward to realising new business opportunities created through cross-referrals between Healthia’s three disciplines to promote better patient outcomes.”

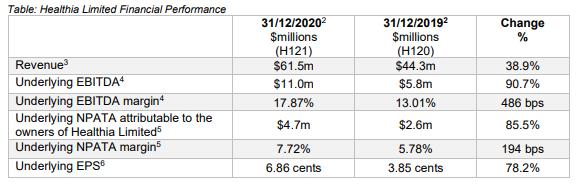

Attributing the strong Half-Year result to increased health consciousness amongst Australians and improved floorspace management of their clinics, Healthia reported a 39% increase in underlying revenue to $61.5m, 91% increase in underlying EBITDA to $11m and 85% increase in underlying NPATA to $4.7m.

Alongside the record H1 results, Healthia shareholders have been rewarded with a 2.00 cents fully franked dividend where the Company also has a fully underwritten dividend reinvestment plan in place to preserve its cash reserves.

Source: Healthia H1 FY21 Results, released 25 February 2021

With Healthia developing as the fastest growing allied health provider in Australia, the best may still be to come given their expansion into optometry and audiology was only settled on 30 November 2020 via their $43m acquisition of The Optical Company.

Expansion into optometry and audiology is expected to follow a similar model to Healthia’s podiatry and physiotherapy clinics which have seen continued organic growth since joining the Healthia network and accessing its supply chains, support staff and marketing initiatives.

This was best evidenced 12 months ago when Healthia reported 5.8% organic growth in their physiotherapy division and 1.3% in their podiatry division. Since bringing all clinics into their national system and vertically integrating supply chains, physiotherapy delivered 15.3% organic growth and podiatry 13.8% for H1 FY21.

Floorspace optimisation is expected to play a major role in Healthia rise up the Australian healthcare market with the Company recently opening a superclinic in Queensland which offers physiotherapy, clinical Pilates, exercise physiology, podiatry, occupational therapy, speech pathology and remedial massage all under one roof.

Committed to spending at least $20m per annum on acquisitions that Healthia is confident they can optimise, the Company recently announced a new financing partnership with NAB that increases their facility to $70m. This will be drawn down over the next few years while acquisitions are funded through a combination of cash flow, clinic class shares and debt.

Healthia will be hosting an online investor briefing on Friday, 26 February at 11.00am AEDT where CEO Wesley Coote will present results, provide an update on their optometry businesses, and field questions from investors and analysts who can register here to attend.

- Harris Technology to expand refurbished tech division amid rising demand from cost-conscious Australians - April 30, 2025

- Harris Technology secures major investment from Taiwan’s FSP Technology at 100% premium - March 10, 2025

- ARC Funds acquires 30% of auzbiz Capital as latest direct-to-investor marketing venture - October 8, 2024

Leave a Comment

You must be logged in to post a comment.