Should investors consider the Lotteries business as an infrastructure asset and if yes what can it be worth?

With the demerger of Tabcorp Holdings into two separate entities – The Lottery Corporation (TLC) and New Tabcorp (TAH) [wagering, media and gaming services] – now set to go ahead, we again highlight what the Lottery business could be worth post separation and what this means for the valuation of the wagering business.

Lotteries – is it an infrastructure asset? Management believes the lottery business should almost be viewed like a infrastructure asset given the business has infra-like characteristics

(1) periodic price increases (approximately at inflation like growth);

(2) monopoly like market position in most Australian states given unique long-dated licenses;

(3) strong support from the government (state governments are very dependent on the revenue they get from lotteries, however, risk remains that governments start demanding an increase to royalties but management hasn’t experienced that as of now); and

(4) mostly recession proof (lottery sales are not highly sensitive to the macro conditions, is habitual to most people and hold up pretty well in downturns given sentiment towards winning money to remain financially stable).

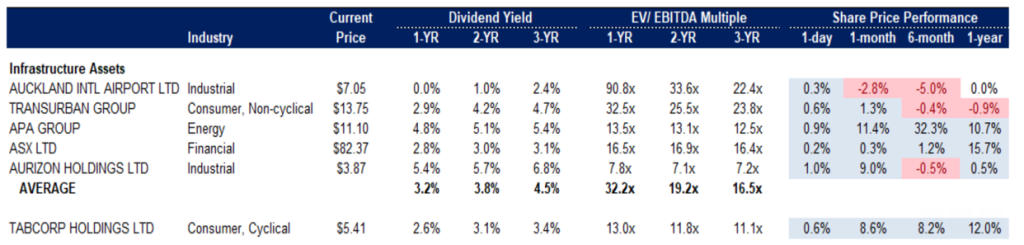

ASX Infrastructure peer group. In the table below we have provided the breakdown of the peer group we used in this exercise. Interestingly, when we did this exercise 2 years ago there was Sydney Airport, AusNet Services and Spark Infrastructure Group also part of this list – now all acquired! 1-Yr numbers are slightly skewed but in any case, given the valuation multiples of this peer group (and what TAH is currently trading on), you can appreciate why management is keen to highlight the valuation uplift potential.

Earnings estimates and valuation. If we take management’s view on face value and ascribe a valuation multiple to the Lotteries business which is more in line with what the ASX-listed infrastructure assets are currently trading on, we come to the result highlighted in yellow in the figure below. Key assumptions are:

(1) Aussie peer group as per table above – somewhat contentious given AIA / TCL skew the multiples to the higher end (one could apply a 15-20% discount as the Lotteries revenue can be lumpy due to the size of jackpots);

(2) Net debt estimates have been derived from the demerger documents.

Banyantree estimates, Company, Bloomberg

The conclusion under these assumptions is that The Lottery business could see significant upside once demerged if this infrastructure narrative sticks and the current share price is ascribing very little value to the remaining New TAH business (Wagering etc)

However, to balance the argument if we use pure play lotteries business as comps (not many around!) for The Lottery Corp to conduct the above exercise we get the following output.

+ Pure play lotteries comps

+ Valuation

We called out Tabcorp Corp (TAH) as a key pick for this year and the stock is well ahead of the market in the current very uncertain times. Further, hopefully the above calculations helps clients understand how to think about its valuation before and post demerger.

- Quick Update: Who bought the dip?Iron ore update + more - August 14, 2024

- What if we are NOT in a new “commodities supercycle”? - August 1, 2024

- Who is going to power the AI boom? - May 30, 2024

Leave a Comment

You must be logged in to post a comment.