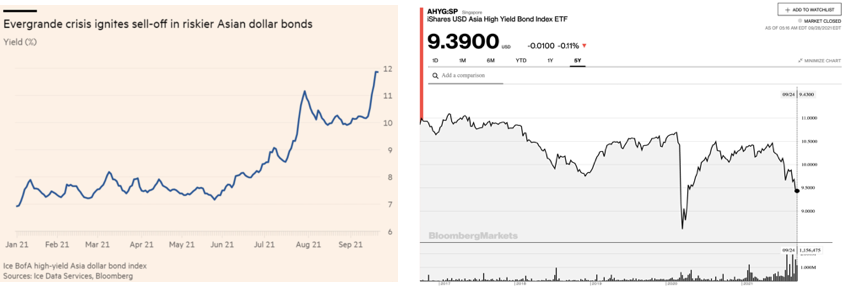

The news of China’s largest property developer failing to meet its obligations to its creditors has sent shock waves in the Asian fixed interest markets, causing the US dollar denominated high yield debt indices to fall half as much as they did in the sell off caused by Covid-19 pandemic in March 2020 (please see below the charts on ICE bond index and Asian high yield $USdollar debt etf). Just exactly what risks and opportunities this shock brings for investors in Asian high yield debt is the subject of this article.

To understand Evergrande’s fall out, one must understand the back story to China’s property market. Chinese property developers have enjoyed an exponential rise in their revenues over the past decade from 4.4 trillion yuan in 2009 to over 16 trillion yuan in 2020. The development activity, in the main, has been focused on residential property rather than commercial real estate. Property prices as recently as 2019 were growing as much as 10% p.a. but slowed to mid-single digit % growth over 2020-2021. House prices have more than doubled since 2015, which in the main is not a dissimilar experience of the run up in residential prices enjoyed by investors in Australia and other developed nations over the same time period.

Many investors observe China’s property market with much scepticism as though it survives on unchecked economics. Often, we hear and read about stats such as Chinese investors in aggregate have much more of their wealth invested in residential property compared to stocks and bonds combined. This is quite the contrast to the investment holdings of US investors who in the main are invested in bonds, followed by stocks and then residential property. There are often other headlines mentioning roughly a quarter of investment properties in urban China sitting vacant with overall rental yields sub 2%. But if you look through the fear inciting headlines there are other facts that positively offset the above mentioned concerns.

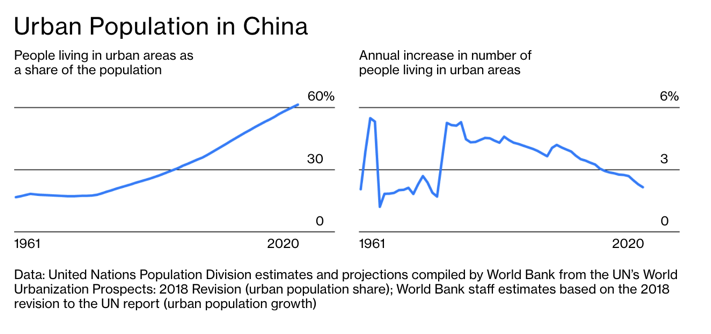

Firstly, China’s urbanisation trend has continued since the 1960s and now sits at 60%, this trend should continue for another 15 years to reach 80% urbanisation rate which is roughly where the US is at today.

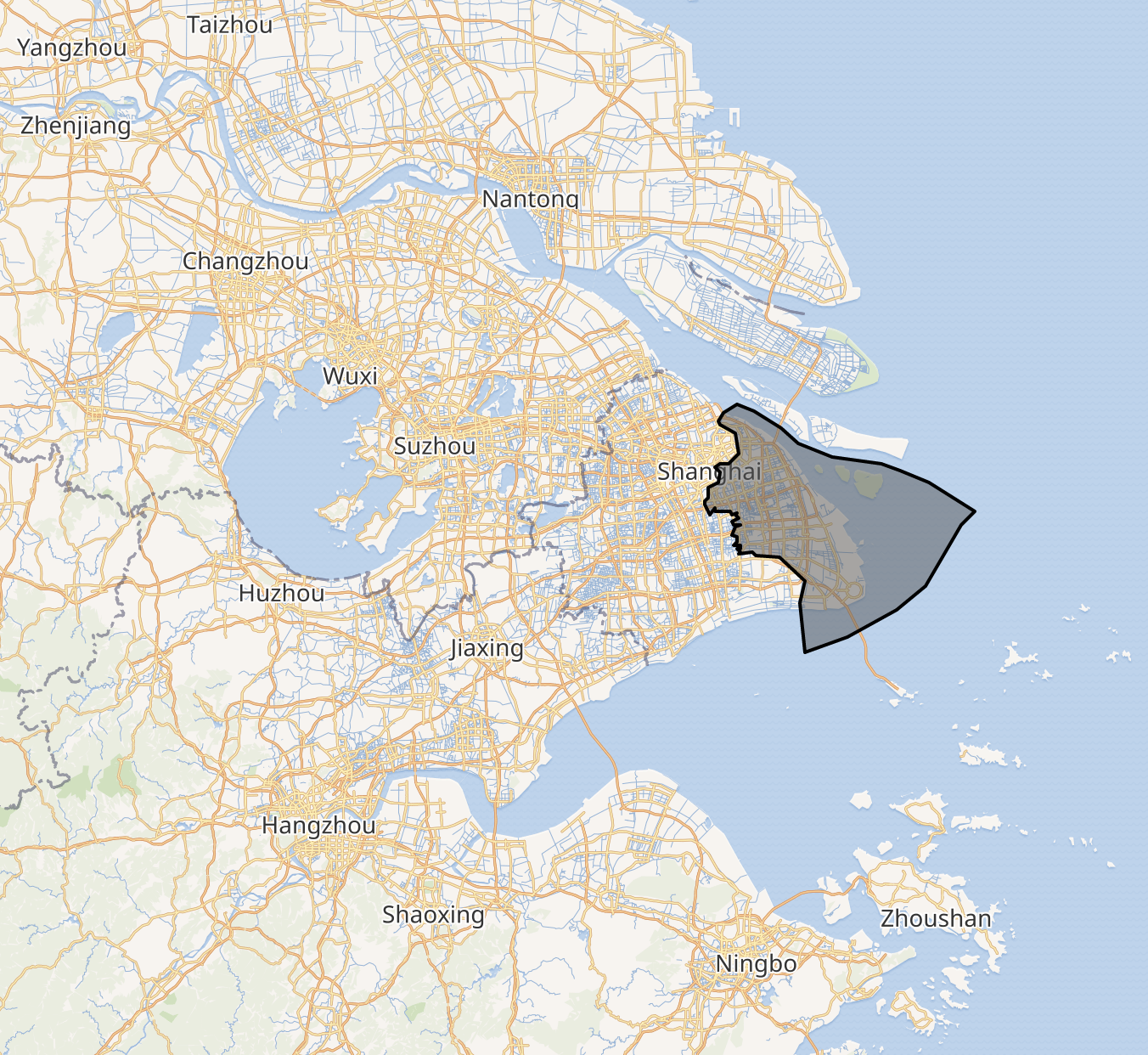

The Chinese government policy encourages urbanisation as it is obviously much more cost effective to service a densely packed population from infrastructure, utilities and civic services perspective not to mention the enormous size of the population that China has. Furthermore, China is a planned economy, so the government tends to plan and layout infrastructure and encourages property investment ahead of the migration trend to newly built cities. The supply leads the demand. There have been many cities that have been reported as ghost cities in the past that have gone on to become bustling metropolises such as Pudong in Shanghai.

This 2010 Headline by Financial Times on Pudong (Map below) stated:

“In the Pudong area of Shanghai in the evening there are whole blocks with almost no lights on. By one estimate, 587m sq m of apartments have been left empty by owners.”

Fast forward to today, Forbes Magazine writes a glowing review on the city as follows:

“For many years after the core of Pudong’s financial district was erected, the skyscrapers sat empty — the steel and glass husks of an unrequited dream of development. International observers and onlookers jeered — the place was the laughingstock of Shanghai. Milton Friedman even called it “a statist monument for a dead pharaoh on the level of the pyramids.” In response to these critics, Mayor Xu Kuangdi admitted that Pudong was like buying a suit a few sizes too big for a growing boy. But the Pudong financial district eventually grew up — now boasting occupancy rates in the ballpark of 99% — and nobody laughs about it being a ghost town anymore.”

So, the point is that vacancy of individual properties does fall as populations move into the newly developed districts and cities over time even though the vacancy stats at the national level remain high as yet newer property stock comes onto the market in other new cities.

Now let’s turn our attention to Evergrande, which is the largest property developer in China with liabilities totaling US$300 billion. It has over 1,300 property projects on its books across 280 cities and interestingly the company has other businesses as wide as food manufacturing and wealth management. The wheels started to come off for Evergrande when in recent months the Chinese government effectively told the banks in China to put a cap on house price growth they would lend against. This meant that buyers found it difficult to get bank loans and settle on properties causing Evergrande to suffer a fall in sales activity thus cash inflows were insufficient to cover the costs, wages and debt servicing. This sent a wave of fear amongst investors holding high yield dollar denominated debt in Asia which traded down well below par value on the assumption of imminent defaults and insolvencies across the property sector in China. The current selloff in Asian dollar denominated high yield debt is most significant since the previous sell off in March 2020 which was followed by a massive rally back to normalised levels.

At the time of writing this piece the interest payments missed by Evegrande have entered a 30 day grace period and if they remain unmet beyond this period then a formal default is a certainty followed by debt restructuring. Given the size of the company and the domino effect it would have on the cost of capital across the property market in China with some 20 million people directly employed in the sector, we see the probability of a contagion as low with the more likely scenario being a debt restructure facilitated by the Chinese government and pain being mostly limited to Evergrande’s bond holders and other creditors.

Disclaimer: The opinions in this article are my own. The contents of this article are opinions only and do not constitute financial advice.

- The inflation we need to have - May 12, 2022

- A Fund Manager’s thoughts on the Magellan situation - February 10, 2022

- Is the Evergrande fall-out presenting an opportunity? - September 30, 2021

Leave a Comment

You must be logged in to post a comment.