The June 2025 quarter CPI data released today were cheered by mortgage holders and share market investors alike. They also put smiles on the faces of Federal politicians on the government side of the house! This because all these groups quickly surmised that these heavily scrutinised price statistics give the Reserve Bank of Australia (RBA) every reason to further ease monetary policy – even allowing for look ahead imponderables like the uncertain impact of increased tariffs likely to feed into consumer prices.

Reflective of this now widespread expectation that the RBA’s benchmark interest rate would be reduced by 25 basis points to 3.60% at its next Board meeting on 11-12 August, the effective rates for both the August and September 2025 bank bill futures contracts are both comfortably under that mark. Indeed, the September contract now partially prices in a further 25-basis point reduction at the following RBA Board meeting on 29-30 September.

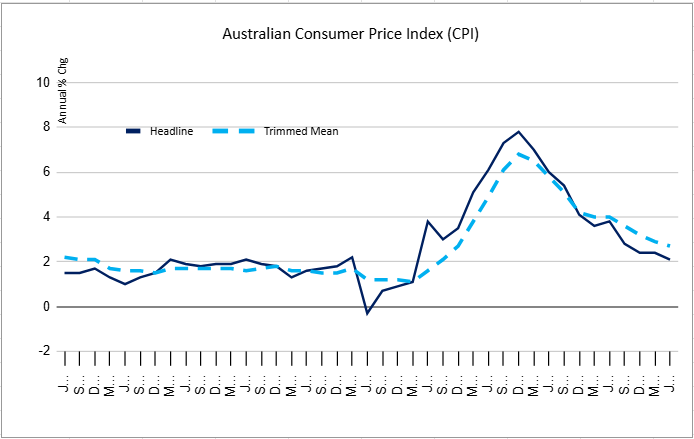

The headline CPI rose by 0.7% in the June 2025 quarter, not too far removed from market expectations. This delivered an annual increase of 2.1%, which was comfortably under the 2.4% figure reported in the March 2025 quarter. The biggest quarterly gainers amongst the headline CPI’s components were Clothing & footwear (+2.6%), Housing (+1.2%), Food and non-alcoholic beverages (+1.0%) and Health (+1.5%). The headline gain would have been higher but for a decline reported in the Transport (-0.7%) category.

Source: ABS and TSN

As usual, most attention was focussed on the Trimmed Mean and Weighted Median underlying inflation measures included in the ABS CPI report. These two inflation indicators are key inputs into the RBA’s monetary policy deliberations and inflation control responsibilities, remembering that the Bank’s inflation charter is to keep annual underlying consumer price inflation between 2-3%.

The Trimmed Mean CPI was 0.6% in the June 2025 quarter, slightly below the prior quarter print of 0.7%. The annual increase of 2.7% was below the 2.9% number reported in the March 2025 quarter, and its lowest reading since back in the December 2021 quarter. The quarterly and annual gains for the accompanying weighted median CPI metric reported in the June 2025 release were also 0.6% and 2.7% respectively.

It is always interesting to see what CPI items were ‘trimmed’ out of the ABS’ Trimmed Mean CPI measure in the latest release. The biggest decliner taken out was Automotive Fuel, which dropped by -3.5% in the June 2025 quarter. The biggest gainers excluded from the June 2025 quarter Trimmed Mean inflation measure was Eggs (+6.5%), a foodstuff still experiencing significant supply shortages, and Electricity (+5.4%) – the latter category’s gain comes as available government provided energy rebates are exhausted.

The stock market quickly rallied after the CPI data were released, and built on these gains over the balance of our Wednesday trading, The A$ slipped back to around the $6505 mark as the CPI data issued and forex traders factored in a likely RBA rate cut in August. The ‘Aussie’ did however recover slightly in later business.

So, it looks like reduced debt repayments are finally on the way for borrowers at the upcoming 11-12 August RBA Board meeting – this after a false start at the earlier 7-8 July meeting when our central bank surprised many market types with a ‘rates unchanged’ decision. However, those interest rate bulls calling for additional multiple rate cuts by the RBA in their subsequent calendar 2025 Board meetings will need to keep an eye on factors – like tariffs and volatility in energy-related prices – that could still rain on their parade.

- FBR’s tech could help reduce housing construction-related cost pressures - August 21, 2025

- June 2025 quarter CPI no roadblock to August RBA rate cut - July 31, 2025

- Australia’s GDP inches higher in March 2025 quarter - June 5, 2025

Leave a Comment

You must be logged in to post a comment.