With local business being the heart of any neighbourhood, LITT is fostering micro-economies within local communities through their latest payments app that rewards residents for supporting local business – fintech powered by Novatti Group (ASX: NOV).

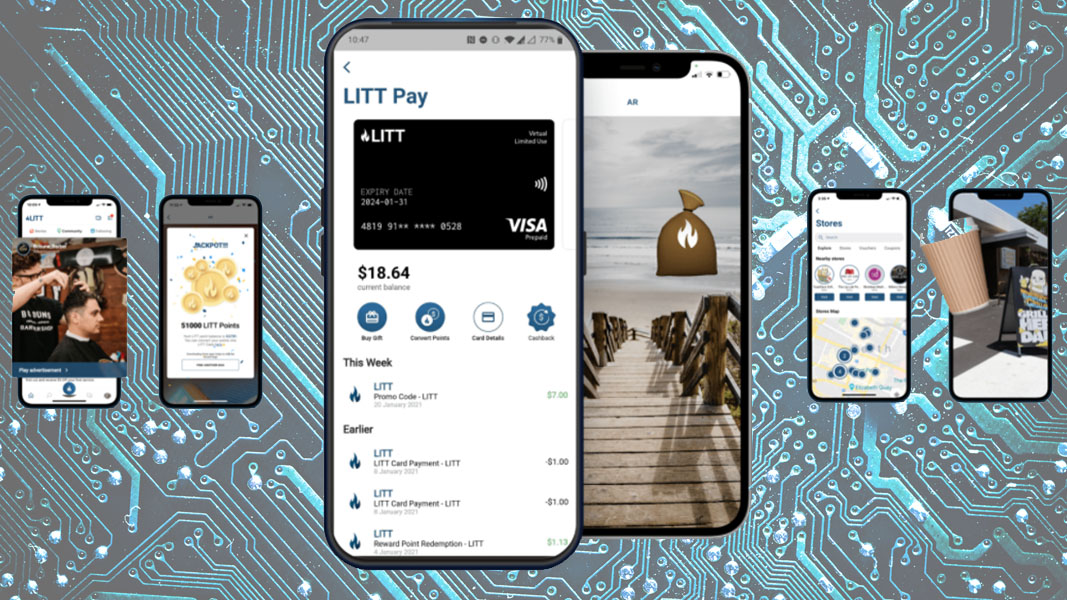

The LITT app is designed to connect individuals with local businesses whereby members can earn LITT cash by viewing local ads or find augmented reality rewards around the neighbourhood. As members collect LITT cash, the app locates nearby businesses that will accept LITT cash as a form of payment, as well as any promotions they have running.

Once users sign up to the app, they receive a personalised prepaid VISA card within the LITT app which stores their acquired LITT cash. This can then be used via tap payment just like a regular credit card at participating businesses courtesy of Novatti’s partnership with Apple Pay, Google Pay and Samsung Pay.

To date, LITT has signed up more than 18,000 members and 500 local businesses that are able to connect and transact with each using Novatti-issued VISA cards.

“Novatti’s collaboration with LITT is another example of how we are creating new potential revenue opportunities by leveraging our existing digital banking and payments ecosystem,” said Novatti Managing Director, Peter Cook.

“The collaboration between Novatti and LITT also highlights the growing convergence of social media and fintech platforms, as payments are placed at the centre of users’ daily lives.

“This convergence creates even more opportunities to see daily life transactions powered by Novatti’s fintech to deliver users a more innovative experience.“

Highlighting the rapid growth of LITT and its supporters, the startup recently raised $1.5 million from 645 new investors via crowd-sourced funding (CSF) in just two days using CSF platform Birchal. This is the maximum that can be raised in Australia through crowdfunding.

“LITT’s campaign is already the biggest for a social media app under the CSF regime yet, and seems to be well on the way to hitting its maximum target early,” said Birchal Co-Founder, Matt Vitale.

Through the collaboration with LITT, Novatti earns fees for project setup, transactions, and card issuing based on the take up of LITT’s services. It is just one collaboration partner that utilises Novatti’s fintech services which facilitate innovative payment ideas at a time when cash usage is rapidly declining.

The strong investor support and rapidly rising user base of LITT comes just one week after another Novatti collaborator tapping their digital payments ecosystem. In January, the Company also reported another collaborator signing up for 50,000 cards.

“This ecosystem has now helped propel several new and innovative businesses, including Novatti’s Digital Payments Accelerator, Lifepay, with its commercial launch last week, and now LITT,” said Cook.

For the Half-Year ending 31 December 2020, Novatti Group reported $7.35m in sales revenue which represented a 49% year-on-year increase.

*Owners of this website are shareholders in a company mentioned in this article and have been engaged by them to assist in investor communications

- Harris Technology to expand refurbished tech division amid rising demand from cost-conscious Australians - April 30, 2025

- Harris Technology secures major investment from Taiwan’s FSP Technology at 100% premium - March 10, 2025

- ARC Funds acquires 30% of auzbiz Capital as latest direct-to-investor marketing venture - October 8, 2024

Leave a Comment

You must be logged in to post a comment.