Happy new year. We have just published a primer on our Sustainable strategy. But I wanted to give a little more colour to the topic. Some points for consideration:

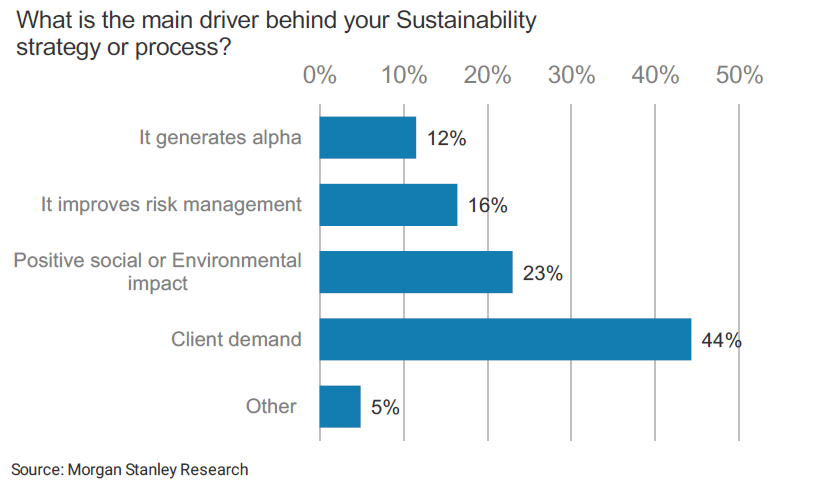

(1) We have of course discussed our approach to Sustainable investing with several clients leading up to this publication and we have incorporated some of these suggestions. During our discussions, we have often noted that most investors see Environmental, Social, and Governance (ESG) as a product to appease the requirements of a particular client. It has never been about, in our view, delivering alpha. In fact some believe ESG parameters on a traditional analytical framework is a constraint. It is a negative mind set. With our views in mind, a client recently sent me the following chart. It is a survey conducted by Morgan Stanley of 100 investors in London. It sums up our point neatly – the response shows alpha is not top of mind of investors. Offering a product is top of mind (that’s our interpretation of “Client Demand”).

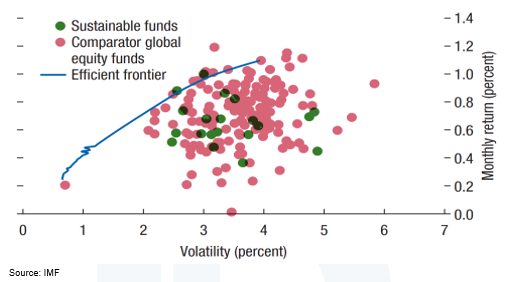

(2) Analysis by IMF suggests ESG funds neither out nor underperform traditional funds (chart below). We used this study because IMF is independent and reputable. This is not a study by ESG product provider to push a particular narrative. This analysis makes sense to us as discussed in the report. ESG incorporated into an investment framework should not detract from performance.

(3) We believe alpha can be added through an ESG strategy. We have run our ESG negative screens over our universe of 2,700 stocks and currently have a pool of approximately 70 ASX stocks and 190 global stocks (this list will be dynamic). The names in this list provide plenty of opportunities in our view. We also try to view each investment in our filtered universe in one of three categories in terms of ESG analysis: lagging (negative), improving (neutral) and leader (positive). Whilst leaders in their ESG commitments will give you good sustainable alpha, it is the companies in the “improving” bucket where we believe clients can derive most alpha. Laggards could be a value trap.

(3) We believe alpha can be added through an ESG strategy. We have run our ESG negative screens over our universe of 2,700 stocks and currently have a pool of approximately 70 ASX stocks and 190 global stocks (this list will be dynamic). The names in this list provide plenty of opportunities in our view. We also try to view each investment in our filtered universe in one of three categories in terms of ESG analysis: lagging (negative), improving (neutral) and leader (positive). Whilst leaders in their ESG commitments will give you good sustainable alpha, it is the companies in the “improving” bucket where we believe clients can derive most alpha. Laggards could be a value trap.

(4) It is important to highlight our investment team has always given consideration to ESG in our analysis of companies. The following table is on the front page of every stock report we publish – this is from Sydney Airport (SYD) latest report.

(5) Financial Sustainability Screens. This may raise a few questions from clients as to why it is part of our Ethical Charter, as it may not be common in other similar strategies. One of the reasons for us to include this explicitly is we want to invest in companies where capital is being properly allocated and management teams are using sustainable capital structures. The global financial crisis (GFC) taught us a valuable lesson on unsustainable debt levels. Whilst it was the consumer at that time (in fact the consumer has rectified its balance sheet in the U.S.), there are plenty of statistics showing debt build up in the corporate sector since the GFC due to easy monetary policies. We can provide evidence of companies in the U.S. using cheap debt to buyback stock rather than investing in their operations. So we believe companies with strong balance sheets, even in a distressed market condition (e.g. recession) will be better placed versus those who are highly leveraged.

- Quick Update: Who bought the dip?Iron ore update + more - August 14, 2024

- What if we are NOT in a new “commodities supercycle”? - August 1, 2024

- Who is going to power the AI boom? - May 30, 2024

Leave a Comment

You must be logged in to post a comment.