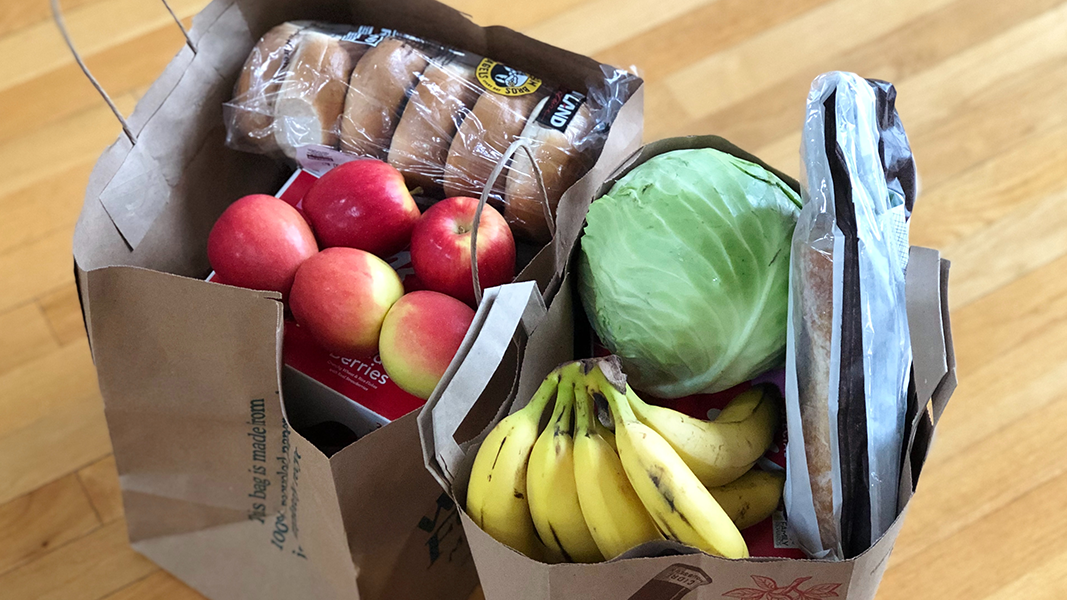

Strike while the iron is hot, or in this case when the target is ice cold. That’s exactly what consumer tech company Rewardle (ASX: RXH) has done as the white knight coming to the rescue of grocery delivery business YourGrocer which stopped taking orders last year and was in the process of being wound up before a last ditch lifeline has been thrown.

After dedicating 10 years of his life building YourGrocer, an online marketplace for local produce delivered to your door, founder Morgan Ranieri and fellow owners will bank a total of $2,898 for the business, broken down as $0.001 per share.

While the amount may be nominal, Ranieri will be delighted to see the business live on and hand over the administration and operational liabilities to Rewardle which will relaunch the business. It will also potentially integrate with Pepper Leaf – a meal kit delivery business part-owned by Rewardle.

“Groceries, points and rewards are a proven winner with Aussie consumers. We believe that the combination of Rewardle and YourGrocer can create an innovative, local community powered grocery service,” said Rewardle Executive Chairman, Ruwan Weerasooriya.

“YourGrocer is a pioneer of grocery delivery in Australia and we have huge respect for what their team achieved. Over the past decade they built a beloved service and brand that brought together an amazing community of customers, employees, producers, and investors.

“We’re excited about the opportunity to build on their work and carry on the mission of enabling local merchants to connect and transact with their local community.”

Unlike failed delivery business Milkrun which has made headlines for all the wrong reasons over the past month, YourGrocer’s strength lies in its focus on localisation. The business never sought to grow beyond its means, rather partnering with independent grocers, fruiterers, butchers and fishmongers in Melbourne with a focus on their local communities. Subsequently, it had substantially lower overheads than other food delivery businesses and operated just a small fleet of vehicles.

For the $2,898 purchase price, Rewardle will take over $301k of YourGrocer assets and $218k worth of liabilities. Ranieri will also stay on as a consultant to Rewardle for three months and will consider participating in an employee share scheme which is yet to be established.

“I’m excited that YourGrocer’s journey and the mission I’ve invested ten years of my life into is not over,” said Ranieri.

“There is a huge opportunity for an innovative service to challenge the well entrenched grocery giants by harnessing changing consumer behaviours and technology to disrupt the status quo.

“I believe Rewardle is well positioned to leverage our many years of work into something very exciting.”

Unlike other businesses that Rewardle takes strategic stakes in, often in exchange for ongoing marketing services, they will take 100% ownership of YourGrocer whose historic financials have not been disclosed.

As a lean organisation, much of Rewardle’s central office work focuses on digital marketing whereby they optimise websites, digital communications and customer acquisition for companies seeking to expand their online presence.

For the Half Year ended 31 December 2022, Rewardle reported $3.1 million revenue and $1.8 million net profit after tax.

Businesses that Rewardle holds strategic stakes in include meal kit delivery business Pepper Leaf, cafe and coffee network platform BeanHunter, buy-now-pay-later business SplitPay and cardiac medtech company Cardiac Rhythm Diagnostics.

These businesses are also supported by Rewardle’s flagship customer rewards platform which partners with local businesses to offer rewards (eg, cards, QR codes etc) that boost customer loyalty and repeat business.

- Harris Technology to expand refurbished tech division amid rising demand from cost-conscious Australians - April 30, 2025

- Harris Technology secures major investment from Taiwan’s FSP Technology at 100% premium - March 10, 2025

- ARC Funds acquires 30% of auzbiz Capital as latest direct-to-investor marketing venture - October 8, 2024

Leave a Comment

You must be logged in to post a comment.