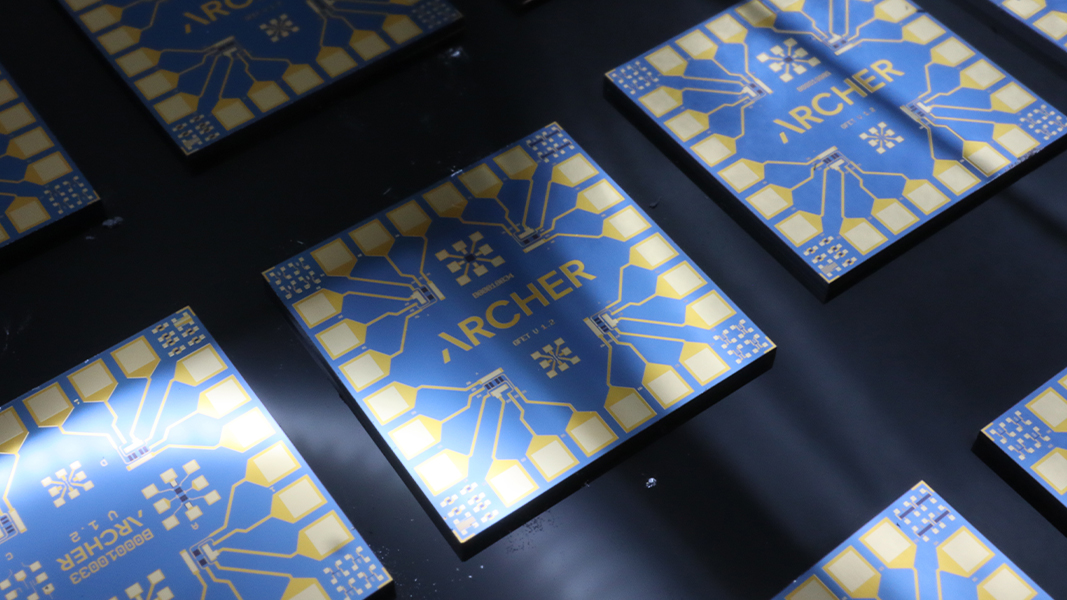

Australian semiconductor company Archer Materials (ASX: AXE) is one step closer to the next generation of medical diagnostics through the successful manufacture of its graphene ‘lab-on-a-chip’ biochip in a commercial semiconductor foundry. Scaling the design and production of graphene chips to be used as biological sensors is a significant challenge to commercialising what could potentially be used as a powerful tool for disease detection and identification.

The successful batch of graphene chips were produced by Archer’s commercial foundry partner in the Netherlands with processes designed to fabricate devices over an entire four-inch wafer, a crucial step in scaling the production of semiconductor chips.

The advanced gFET chip designs would have undergone rigorous fabrication processes to meet Archer’s expectations, considering graphene is a single atom thick of carbon and a niche material in commercial foundries. Both the electronic and spectroscopic characteristics of the gFET chips, along with the foundry fabrication process yield, aligned with Archer’s specifications.

The achievement with the biochip gFET sensor chip design paves the way for Archer’s biochip platform that promises single-device multiplexing capabilities. This tech capability would enable the electronic detection and analysis of multiple liquid samples, making it a powerful tool for the medical industry. Biochips aim to help provide a solution for healthcare professionals to quickly and accurately diagnose a range of diseases.

Successfully running the four-inch wafer semiconductor fabrication processes in the Netherlands validates Archer’s complex biochip sensor design and commercial profile, an achievement to highlighted by Archer CEO Dr Mohammad Choucair.

“Archer’s biochip graphene sensor technology has essentially undergone translation from design to scalable semiconductor processing in a commercial foundry, which is both a key technology development and commercial milestone,” said Dr Choucair.

“The whole wafer fabrication of the gFET device design is a significant step towards industrial production. Archer is continuing to strengthen its relationships with global foundry partners to deliver these chips using a streamlined ‘fabless’ commercialisation model.”

The Archer biochip, powered by graphene field effect transistors, represents a revolutionary leap in diagnostics that is occurring post-pandemic. Biochips require deep knowledge and application of bioelectronics, involving miniaturising integrated circuits designed to perform various biochemical analyses on tiny liquid samples. They are often referred to as a ‘lab-on-a-chip’ because of their ability to carry out complex analytical tasks typically conducted in a laboratory setting. Archer now intends to integrate more functionality on its biochip.

One of the most compelling advantages of Archer’s biochip technology is its capacity for single-device multiplexing using ultrasensitive graphene transistors. Traditional diagnostic methods often require multiple tests and time-consuming processes to identify different diseases or pathogens. However, Archer’s biochip has the potential to simultaneously test for multiple diseases or analytes using a single device without the need for the cold logistics supply-chain, significantly reducing the time and resources required for diagnosis.

This breakthrough technology has the potential to transform the medical industry by enabling rapid, cost-effective, and highly accurate disease detection. Healthcare professionals can use these biochips for various applications, including early disease diagnosis, drug development, and monitoring patients’ health conditions.

By undertaking a partnership approach with commercial foundries, Archer is committed to being a ‘fabless’ semiconductor company that will outsource the large-scale manufacturing of its semiconductor chips. The approach is one that enables the company to focus on developing its tech more efficiently, without the huge capital investment required to build large-scale manufacturing facilities.

Archer is well capitalised with $23.3 million of cash on hand as of 30 June 2023 having reported just $3m in cash outflows in FY23, highlighting the strategic direction of the company to focus on developing its tech and then partnering with commercial foundries for manufacturing.

This more advanced gFET design produced in the Netherlands ran in parallel with Archer’s first-generation biochip design which was submitted to a commercial foundry in Germany for a ‘Multi-Project Wafer’ run which is ongoing. Those devices being produced in Germany are expected to be completed and returned to Archer by the end of 2023.

- Harris Technology to expand refurbished tech division amid rising demand from cost-conscious Australians - April 30, 2025

- Harris Technology secures major investment from Taiwan’s FSP Technology at 100% premium - March 10, 2025

- ARC Funds acquires 30% of auzbiz Capital as latest direct-to-investor marketing venture - October 8, 2024

Leave a Comment

You must be logged in to post a comment.