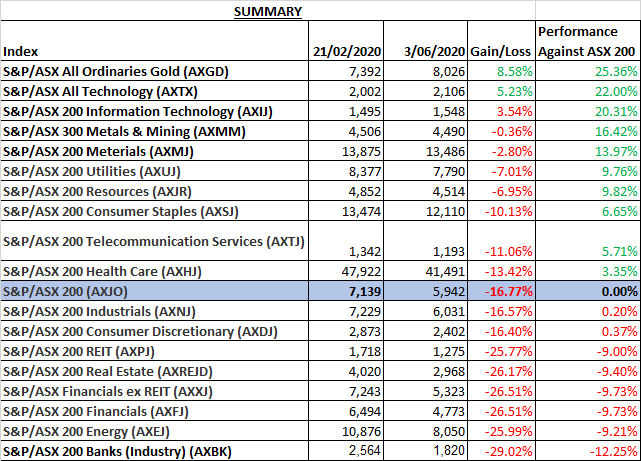

Most of the Australian population in January would not have believed that in only a few months, the XJO would fall from a high of 7162 to 4402, numbers that it has not seen in over four years. While it has somewhat recovered with the index currently sitting around the 6000 mark, some indexes have performed better than the top 200 companies which are down 16.77% from 2/21/2020 to 3/6/2020, and some much worse.

Healthcare (AXHJ) is currently outperforming the XJO by over 3.3%. It makes sense that people do not stop needing health services during economic uncertainty, and COVID-19 has provided an opportunity for small cap healthcare companies to list, during a time when floats have been extremely quiet. During the GFC, the Australian healthcare index dropped approximately 15%, considerably less than the XJO’s fall of almost 37%, with the U.S presenting similar statistics.

All Technology (AXTX) and Information Technology (AXU) are other sectors that have performed exceptionally well against the XJO, up 22% and 20.31% respectively. The sectors which includes companies like Kogan (ASX: KGN) has risen over 110% and Afterpay (ASX: APT) over 34%, seem to be benefiting from the increase in online shopping and the need to work from home, a trend which in the U.S has seen Zoom Video Communications (NASDAQ: ZM) surge over 97% since the beginning of March.

While the panic buying and sharp increase in drinking habits has benefited the Consumer Staples index (ASX: ASXJ) which includes food, alcohol, and vitamin companies, has also outperformed the XJO by almost 7%, it hasn’t completely offset all COVID impacts, still down over 10%.

Consumers have been buying up on items that keep boredom at bay. Video games and consoles have seen a steep increase in sales globally and Nintendo Switches have been hard to come by due to the increase in demand. Such buying behaviour has been reflected in the market, JB Hi-Fi (ASX: JBH) is actually slightly up compared to pre-COVID prices and significantly better off than the top 200. The Consumer Discretionary index (ASX: AXDJ) as a whole is down more compared to the XJO, with the leaders not quite offsetting the laggers including Flight Centre (ASX: FLT) and Webjet (ASX: WEB) down 60.69% and 56.27%.

The banks, financials, and real estate sectors have surprisingly underperformed the XJO significantly. The banking sector (ASX: AXBK) is down a considerable 29%, such a plunge a reflection of the RBA consistently dropping interest rates, the so-called ‘mortgage holidays’ in effect until september and the $45bn of bad debt that could eventuate across the big four alone. ANZ and Westpac have also axed their interim dividend payments. ANZ CEO, Mr Shayne Elliot said that the company learned during the GFC that economies take time to recover and it “could take 3 to 5 years for employment to fully recover”.

The Real Estate index (ASX: AXREJD) and the REIT index (ASX: AXPJ) have also both underperformed the benchmark by almost 10%, down over 25% in total. Increases in commercial vacancy rates, falling rent prices, and declining commercial property values have affected the REIT industry. In the residential sector, plunging clearance rates, low market volume, and predictions the market could fall even further, have increased investor uncertainty

- This small biotech is the definition of a quiet achiever, here’s why it might be time to tune in - November 25, 2021

- New CEO flags 100-day plan for Crowd Media’s conversational AI platform - October 19, 2021

- Healthia emerges as largest physiotherapy provider with $88m acquisition, more growth still to come - September 22, 2021

1 Comment

… [Trackback]

[…] There you will find 35422 more Infos: thesentiment.com.au/technology-and-i-t-lead-asx-market-performance-by-sector-through-covid-19/ […]

Reply