Last week the Treasurer, Josh Frydenberg, revealed that the 2018 – 19 budget showed a deficit of only $690m. The Treasurer said: “Our strong fiscal management has put the budget on a sustainable trajectory, ensuring that we can guarantee the essential services that Australians need and deserve”.

The Government frames a balanced budget as basically being back in the black and would require less Government debt to be issued. The critics of having a budget in balance is that a lack of Government spending constrains the struggling consumer.

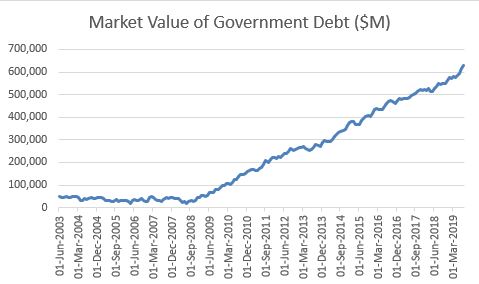

Looking at the data provided by the AOFM (Australian Office of Financial Management) shows that Government outstanding debt has grown from $20 Billion in July 2008 to $629 Billion by the end of August 2019.

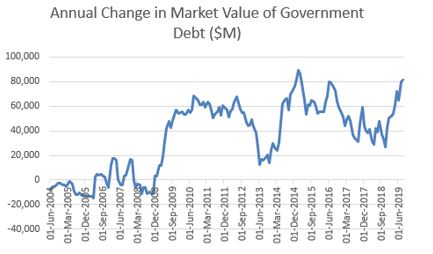

Over the last 12 months, the market value of Government debt increased by $81 Billion. In fairness, the market value has increased, in part, because previous debt issued has increased in value because of falling interest rates, not because the Government spent it. But the AOFM figures does show that an additional $27 Billion face value of debt was issued. If these funds are used for Capital expenditure, like infrastructure, then the Government still gets to claim that they are still running a balanced budget.

So politically, everybody gets to be right: The Government is running a balanced budget and their critics should be happy because the Government is still borrowing to put money into the economy by spending on infrastructure and capital works.

Rhetoric aside, the problem of course is that Australia is on an ever-increasing debt trajectory. Should an economic downturn eventuate, then the Government will be forced to stimulate the economy with increased spending. Australia is not in a fiscal conservative position, as the balanced budget would imply. Should a recession eventuate, the high debt levels will certainly compound the problems.

- How the Chevron Doctrine decision could shake the environment and investors - July 10, 2024

- Why a tsunami of liquidity might be on its way - July 5, 2024

- A quick explainer on Hybrids and why people trade them - June 24, 2024

Leave a Comment

You must be logged in to post a comment.