We take a look at the Federal Budget and the massive new spending measures

Last Tuesday night, Josh Frydenberg announced the Australian Federal Budget for 2020-21. Spending is expected to increase by a massive $128 billion or 23 percent, with around $111bn of this new spending commitments. Despite this, receipts are expected to drop by 1.2 percent, and as a result, the Federal Government is expected to run a massive $213 billion deficit this year.

This massive deficit can be seen as the Federal Government pumping money into the Australian economy, which they will do to help combat the negative economic effects of COVID-19.

So, what are they doing with all this money? And who will be the beneficiaries?

Employment:

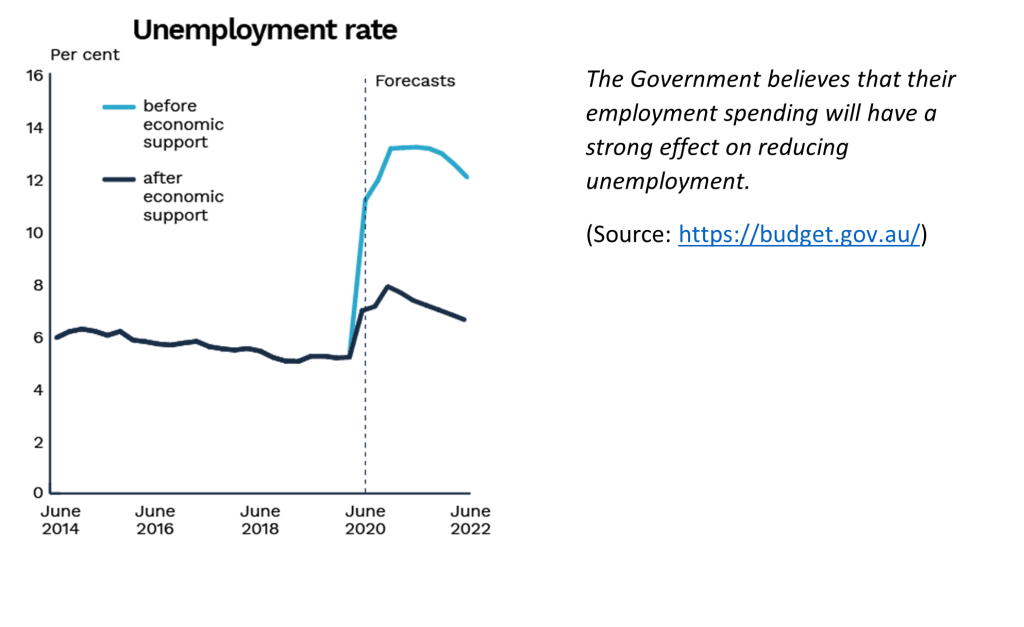

Employment was a major focus of this budget, which is unsurprising given that this government has strongly emphasised the importance of Australian jobs. New measures have been announced to promote increased employment, including billions for the JobMaker and JobTrainer programs, aimed at providing education and employment for younger Australians. There will also be subsidies for hiring new apprentices, and investments in infrastructure, defence, and healthcare that are designed to support employment.

Taxation

Tax cuts for individuals and businesses have been announced as well. More than seven million Australians will be $2,000 or more better off this year after the personal income tax changes. There will also be tax changes that benefit the majority of businesses, with instant tax write-offs and carry-back of losses. There were additional measures announced as well, including some exemptions to fringe benefits tax.

Other spending:

Billions in additional spending has been committed to industries like healthcare, with the National Disability Insurance Scheme (NDIS) receiving a large funding boost. Infrastructure investment will also receive a boost, with spending designed to increase employment and fast-track major projects. This is on top of this is increased support for residential construction, including an expansion of the first-home buyer deposit scheme. Also announced were research and development incentives, as well as funding for cybersecurity and clean and renewable energies.

So far, the measures have been extremely well received by the Australian share market, with our XJO index of our 200 largest listed stocks rallying post the budget announcement. However, after the initial optimism, it is likely that movements will be more stock specific, with gains favouring the beneficiaries of the budget.

We will be running a special edition webcast on Thursday 15th of October at 7:00 PM, where we will run through the measures that have been announced, as well as the winners and losers. Join us for this free event hear a market-focused budget review, as well as to ask our Emerald advisors any questions you may have. You can sign up to this free event by clicking here:

- XJO to rise despite slight US pullback - August 30, 2024

- Markets jump strongly higher - July 29, 2024

- US shares drop with tech selling, XJO to continue lower - July 25, 2024

Leave a Comment

You must be logged in to post a comment.