One of the latest trends in the Australian investing world is the US market. Many Australian investors are flocking to the US to enhance their portfolio performance by either buying broad exposure via Exchange Traded Funds (ETFs) on the Australian market or by finding providers that allow Australian residents to buy and own US shares. But why now?

Well, it becomes obvious when you look at the below chart, which is the US and Australian accumulation index performance over the last 10 years. The Accumulation index not only measures share price change, but also adds in dividends. It simulates a portfolio of all the stocks in the index if all cash payments are reinvested. The reason I look at this over the normal SP500 or XJO is that Australian companies typically payout much larger dividends than the US.

So, looking at a 10-year period we can see that the US markets have outperformed our market by 168%…… even with dividends being reinvested. So, if you invested 20K USD (20.6K AUD the exchange rates were almost equal in late 2011) you would have made a profit of $37,827 USD in the past 10 years. ($50,310 AUD). An Australian only portfolio over the same period would have seen a profit of $14,113 AUD. Now you must remember that past returns don’t guarantee the same thing will happen in the future, plus the move in currency also enhanced the profit here considerably.

But one would have to say that even when taking currency out of the equation, a well thought out US portfolio in the top 500 stocks would very much outperform a well thought out Australian portfolio in the top 200.

We believe that having a diversified portfolio is always best. In saying that, it now goes beyond just sector diversification, but also country and market diversification.

Fractional trading has also become more popular which helps investors that want to buy a portion of a share. This is important for one who wants to buy something like Tesla which is worth more than $1,000 per share.

In the past it was very expensive to get involved in the US markets. Between brokerage rates, exchange fees and knowing what and when to buy or sell.

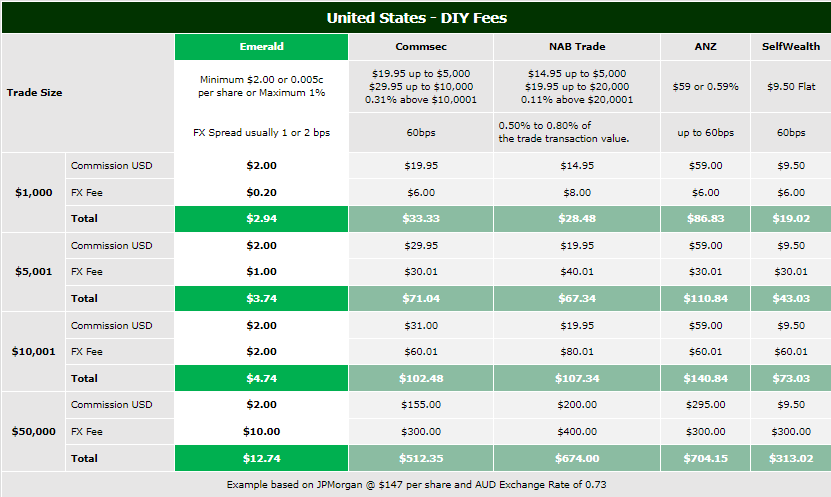

This is all changing. With an array of cheap and free brokerage offerings. Looking at the below table you can see that we have also just launched our own US offering. With our do it yourself account you will pay just $2.00 USD or 0.005c per share.

Looking at the above example, a $10K trade including currency fees is only $4.74 AUD. Based on buying JP Morgan at $147 per share and a currency conversion rate of $0.73.

This is why people are getting excited. In the past, investors would be paying upwards of $71.00 for a trade like this. Even with some of the newer free providers you still need to watch out for the currency conversion fees. If you convert $10,000 from AUD to USD and get charged 60bps that is $60. With us that could be more than 12 trades at $5 a trade as we do not charge currency conversion fees.

Looking at the earlier example of making $37,827 USD from a 10-year trade converting that back to AUD on a 60bps charge you would pay $226.96. With us, you would pay only the spread which is usually 1 or 2bps. ($7.57)

We also offer an advisor assisted model. For an extra fee, we can help you place your trades. This is handy for beginners, those who are not computer savvy, or for those who are busy and don’t have time to DIY.

Next week we’ll be running a special webcast on this topic, click here to register.

- US markets turn red at close as Netflix disappoints on subscriber growth - January 21, 2022

- Tech gets hammered as investors move back to Value - December 17, 2021

- Why are Aussie investors flocking to US markets? - November 18, 2021

Leave a Comment

You must be logged in to post a comment.