Weeks after Netflix raised its subscription prices, Amazon (NASDAQ: AMZN) is set to jump on the bandwagon and bump up the cost of its Amazon Prime membership, which was announced alongside its December quarter earnings as investors responded well to the margin hike.

The cost of an Amazon Prime membership, which gives the customer free one or two-day package delivery and access to benefits like the Amazon streaming service, is increasing its cost to $139 per year or $14.99 per month. This would be a 15.3% increase on the $12.99 per month members are currently paying. With over 200 million members globally, the membership increase would provide $400m in additional monthly revenue. The markup comes as Amazon continues to battle with competition like Netflix and Disney Plus for streaming service customers while all are investing heavily in their content offering.

This December quarter delivered USD $137.4b in revenue, meeting expectations around $138b. Including profits increasing to $14.3b, almost doubling from $7.2b a year prior. The Company also achieved $27.75 net Earnings Per Share (EPS), compared to $14.09 EPS one year ago.

Amazon has projected revenue for the March quarter to be $112b – $117b, with the decline in line with the busy retail season within the December quarter that included Black Friday, Cyber Monday and Christmas.

“As expected over the holidays, we saw higher costs driven by labour supply shortages and inflationary pressures, and these issues persisted in the first quarter due to Omicron,” said Amazon CEO, Andy Jassy.

“Despite these short-term challenges, we continue to feel optimistic and excited about the business as we emerge from the pandemic”.

“Given the extraordinary growth we saw in 2020 when customers predominantly stayed home, and the fact we’ve continued to grow on top of that in 2021, our Retail teammates have effectively operated in peak mode for almost two years.”

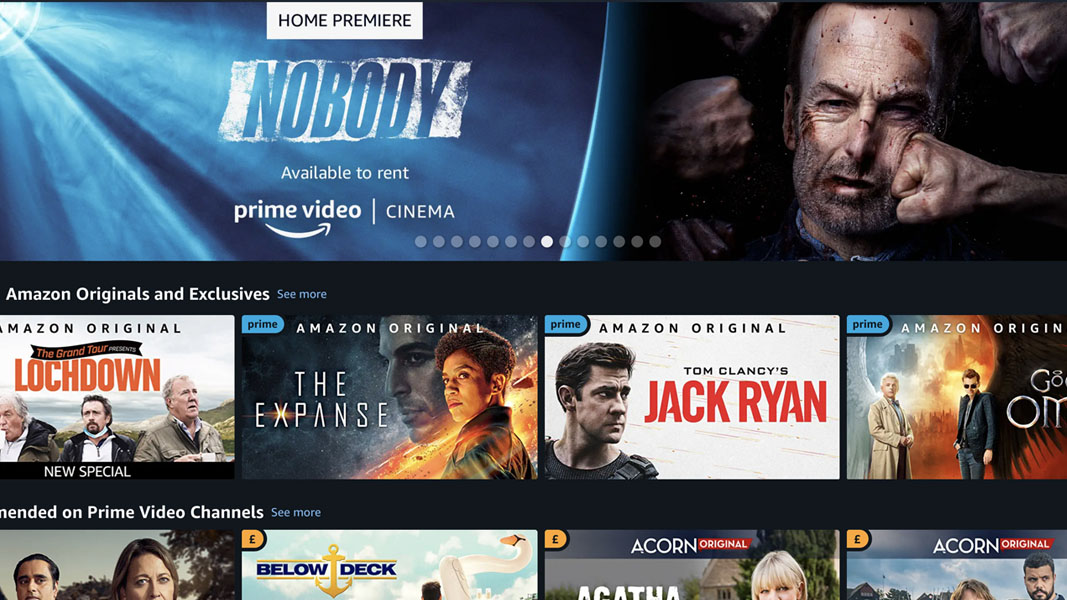

As the streaming wars wage on, Amazon has gained a leg up on Netflix and Disney Plus and will become the exclusive home of “Thursday Night Football” games, which is expected to bring in a heavy amount of traffic. The Company recently signed an 11-year deal to stream NFL games exclusively on Amazon Prime.

With Amazon agreeing to pay over USD $1b annually for the rights, Amazon anticipates recouping its return on that investment with its increased membership prices – while Disney pays USD $2.7b for a similar sports package with less content. Over the next 11 years until 2033, the streaming rights are expected to bring in over $100b in profits for the service.

Along with its NFL content, Amazon is set to release 3x the number of exclusive shows and movies compared to 2021. The Company has its sights set on the Lord of the Rings TV show adaptation that will hopefully satisfy the customers who do not watch football.

Amazon shares last year reached its peak of $3,773 in July, then began tracking sideways, dropping nearly 10% and finishing the year at $3,408. Following the report, AMZN shares jumped as much as 19% in after-market trading, after investors took the report and Prime price increase quite positively.

- UNITH delivers eSocial Worker for public health services across 14 countries - December 5, 2023

- Novatti cashing out of Reckon investment, clears debt to simplify payments business - November 17, 2023

- Novatti seizes opportunity in Australia’s cashless transition as revenues rise while expenses drop - October 30, 2023

Leave a Comment

You must be logged in to post a comment.