When it comes to gambling in Australia, punters have a plethora of service providers to assist them with their bets across lottery, sports, racing or even pokies. Such a lucrative market for providers regularly leads to a battle for market share, one that is changing tides against online lottery company, Jumbo Interactive (ASX: JIN).

The recent shakeup in the Australian lottery industry was led by Tabcorp (ASX: TAH), which recently demerged its lottery and keno division as The Lottery Corporation (ASX: TLC) to delineate the hugely profitable business from its fledgling Tabcorp wagering business.

The move effectively protects profits from being cannibalised by the loss-making wagering division, which has consistently been a step behind their online-only competitors.

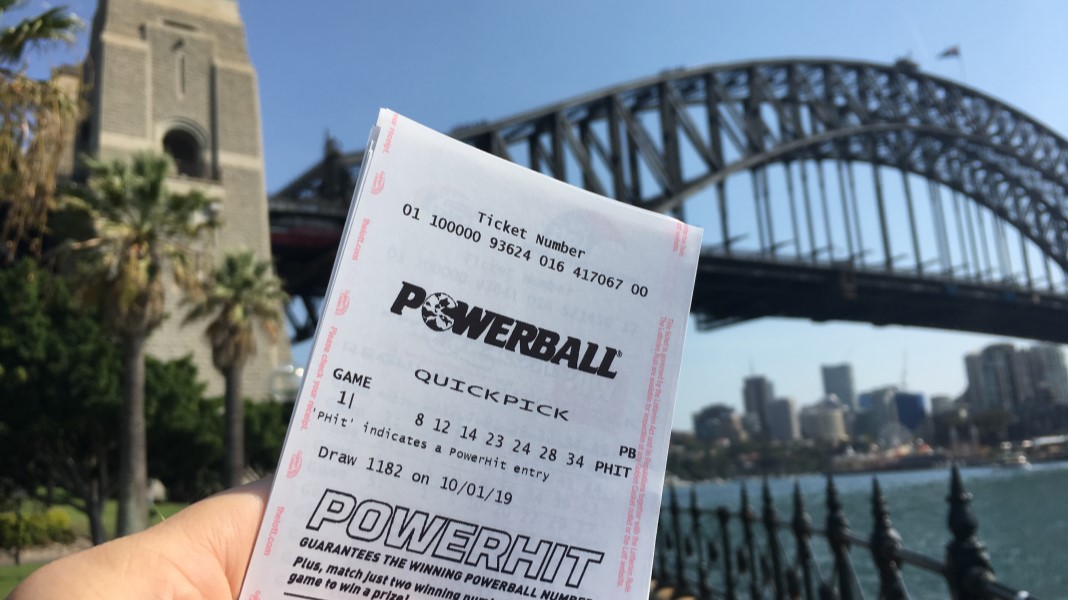

The demerger of the The Lottery Corporation came not long after the companies formalised a long-term extension of the existing reseller agreement with Jumbo Interactive (ASX: JIN), which enabled Jumbo to continue selling lottery tickets through its OzLotteries platform – the long time first point-of-contact for Australians looking to buy lottery tickets online, with the ease of online payment and cashing out winnings.

“Our seamless transition to the new Tabcorp Agreement and strong performance in our Lottery Retailing segment is noteworthy. These continue to deliver steady growth at low jackpot levels, while boosting sales significantly at the larger jackpots,” said Jumbo CEO, Mike Veverka in a company update dated 26 August 2021.

As outlined in a preliminary FY22 results update that Jumbo released today, its underlying net profit after tax (NPAT) was up 16% to $31.6 million year-over-year (YoY), along with revenue climbing a staggering 36% to $660.1 million YoY.

Despite these impressive numbers, JIN shares have dumped nearly 15% today from $14.48 to $12.33. The price tanked partially due to the demerger of The Lottery Corporation being part of a wider plan to increase their online sales, being the actual operators of the lottery draws. This will lead to an increase to service fees for online lottery ticket sales that would be charged to third-party operators like Jumbo Interactive.

Going forward, the service fee will sit at its revised amount of 3.5%, compared to 2.5% in FY22, which will notably dampen Jumbo’s future earnings, as customers instead head directly to TLC’s online app, The Lott.

The changing landscape comes after Veverka sold $12.6 million worth of his JIN shares on-market in April 2022 when JIN shares were trading around $19 each before they fell to their 52-week low today at $12.33.

- UNITH delivers eSocial Worker for public health services across 14 countries - December 5, 2023

- Novatti cashing out of Reckon investment, clears debt to simplify payments business - November 17, 2023

- Novatti seizes opportunity in Australia’s cashless transition as revenues rise while expenses drop - October 30, 2023

Leave a Comment

You must be logged in to post a comment.