Small miners, like most small-cap stocks, trade based on the announcement of milestones; Discovery of promising exploration sites, proving of reserves, and completing feasibility studies. However, usually the biggest jump in a small miner’s share price is when they announce the start of resource production. This is a milestone that many small miners don’t reach, but when it is achieved, it is usually to the immediate benefit of existing shareholders.

That is what attracted me to Specialty Metals International (SEI.ASX).

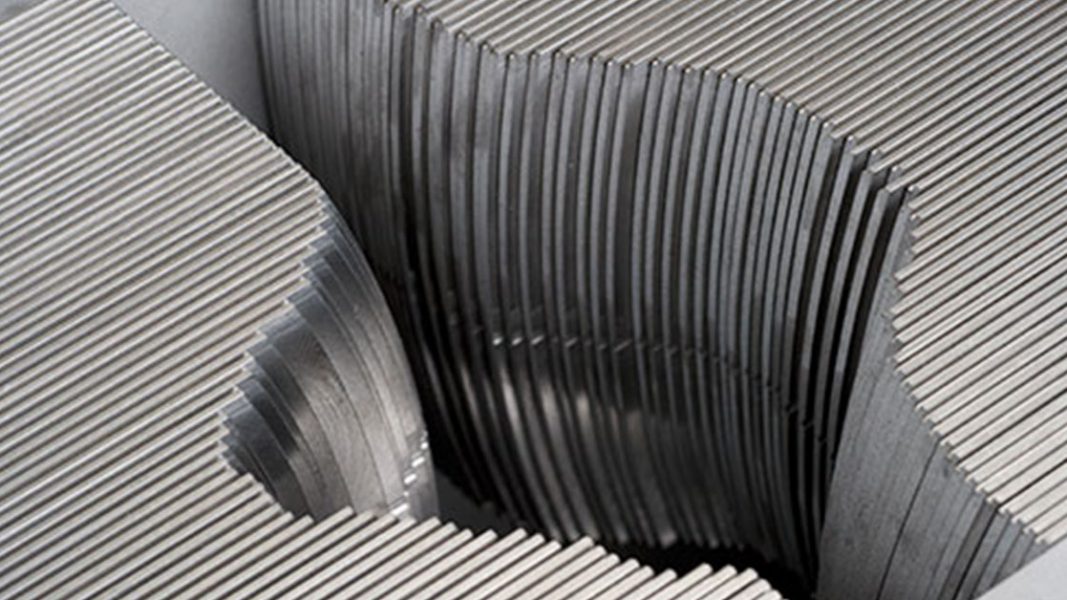

Specialty Metals focuses on the exploration and development of tungsten, gold, and lithium projects. Their flagship project is the Mt Carbine tungsten mine in Far North Queensland. The mine was previously a producing tungsten mine but shut it in the late 80’s due to weak tungsten prices. Times, prices, and mining technology has all changed since then, and Specialty Metals International is now in the process of restarting production at this mine and plans to be a pre-eminent Australian tungsten producer.

The mine also has the largest rock quarry in Northern Queensland attached, which has been operating with positive cash flow for some time. This will provide some additional fuel for SEI’s income statement. Moving forward, the company sees plenty of synergy between waste rock from the mining operation and feed rock for the quarry.

The main target is tungsten production, and to that end, the company is close to completing the construction of a tailings retreatment plant, which they state should see commissioning and commencement of production in the fourth quarter of 2019.

That means that SEI plans to make an announcement of production commencement in the next few months, which when announced, I believe will lead to a share price appreciation.

The Australian government has highlighted tungsten as a ‘critical mineral’, which it defines as metals that fulfill ‘important economic functions, can’t be easily substituted and which face some degree of supply risk’. These are metals that are ‘important for industrial progress and emerging technologies’, with ‘growth in these markets is expected to boost world demand for critical minerals’.

If you would like to hear more about Special Metals International (SEI.ASX), or would like to discuss other small cap ideas, don’t hesitate to contact Adviser Sam Green on 03 8080 5788, or at sam.green@traderscircle.com.au

- XJO to rise despite slight US pullback - August 30, 2024

- Markets jump strongly higher - July 29, 2024

- US shares drop with tech selling, XJO to continue lower - July 25, 2024

Leave a Comment

You must be logged in to post a comment.