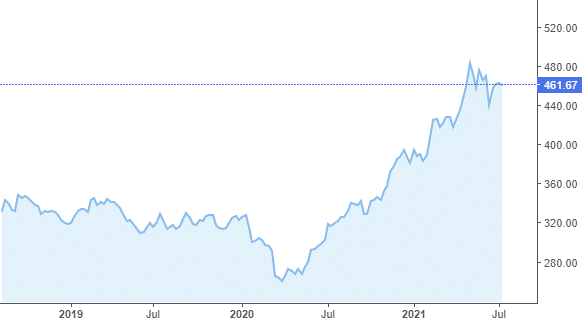

Industrial Metals prices are trading at all-time highs at the moment, which would have been unbelievable just twelve months ago. A combination of large amounts of government stimulus, as well as expansionary monetary policy has helped to fuel these record prices, but monetary and fiscal policy alone does not explain what we are seeing.

What else has led to the price growth?

Generally, when prices grow it is either as a function of increased demand, lower supply, or sometimes both. In the case of metals price gains recently, we can see there are multiple factors on each side of the curve at play.

Supply factors:

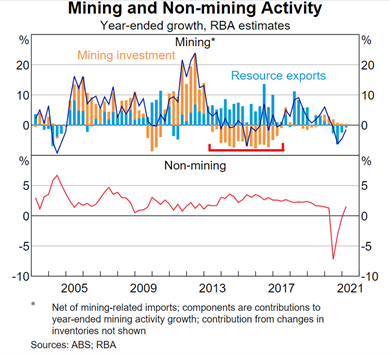

As the above chart shows, there were series declines in Australian mining investment between 2013 and 2017, which was repeated in many mining jurisdictions around the world. Given that mines frequently take years to bring into production, that drop in investment in the mid-2010s is likely being reflected in by relatively lower supply at the moment.

For example, global copper production has largely flatlined across the past five years, and production even fell a significant degree in 2020.

Another recent contributor to weaker supply has been the COVID-19 pandemic. That aforementioned drop in copper production was at least partially due the impacts of COVID-19.

It is extremely difficult to estimate the impact of COVID-19 on mining production, as it is not just mines that have closed down due to COVID, but also mines that have had some impact despite remaining open.

Anecdotally, several iron ore mines in Western Australia have struggled to maintain the usual rotation of ‘fly-in, fly-out’ workers from the Eastern States, which will likely have had a material, if difficult to quantify, impact on production.

A relatively lower supply of metals may certainly have helped to push prices higher, but resilient and perhaps even growing demand also played a part in the bullish price movements.

Demand factors:

The biggest driver of relatively stronger demand for metals has been the record monetary and fiscal stimulus that has been released in response to the virus. This has driven up demand for consumer goods and driven increases in industrial production.

The biggest consumer market on earth, the US, has seen individuals handed multiple cash cheques from the government and similar programs elsewhere have also put money in consumers’ pockets. This additional funding has helped keep consumer demand strong through the COVID-19 period.

Demand for new technology has been particularly strong, with workers needing to upgrade their working-from-home setups and those in lockdown needing to utilise entertainment goods in their own home.

Will the trend continue?

Future technologies are expected to drive future increases in demand for industrial metals, as the technologies that replace fossil fuels will require more industrial metals in production. Batteries, electric vehicles, wind turbines, solar panels, all require large amounts of industrial metals to manufacture.

The effect on copper demand is expected to be particularly pronounced. Some analysts have called copper ‘the new oil’ and stated that the world will experience great shortages in the metal across the next five years.

However, demand for just about every industrial metal should remain strong, according to a paper publish in the Resources, Conservation & Recycling journal, who showed strong expected growth in demand through to 2050, led by aluminium (215%), followed by copper (140%), nickel (140%), iron (86%), zinc (81%), and lead (46%).

The further stated that “demand for all major metals, except lead, is expected to increase continuously by the end of this century, with the largest growth rate for aluminum (470%), followed by copper (330%), zinc (130%), and iron (100%).” (Takuma Watari, 2021)

And while demand is expected to increase, future supply could be metal supply could be limited by physical, economic, social or environmental factors according to a 2019 study (Lèbre et al., 2019). Recycling efforts will likely add to supply, but they are unlikely to be sufficient to cover the strong expected increases in demand.

The current price gains for metals could potentially moderate in the short-term as markets accommodate for the short-term effects of the coronavirus, high shipping costs, and demand that has been adjusted by government policy. But in the medium and longer terms, the outlook for metals prices in the 21st Century remains bullish.

- XJO to rise despite slight US pullback - August 30, 2024

- Markets jump strongly higher - July 29, 2024

- US shares drop with tech selling, XJO to continue lower - July 25, 2024

Leave a Comment

You must be logged in to post a comment.