Grocery giant Woolworths Group (ASX: WOW) has gone shopping, and come home with what they think is a pretty good deal. Finally entering the marketplace style retailer market, WOW has entered into a binding agreement to acquire the majority stake of online retailer MyDeal (ASX: MYD).

WOW is offering an all-cash consideration of $1.05 per share, a 62.8% premium on the last closing MYD share price of $0.65 representing an enterprise value of $242.6 million. Following the acquisition MyDeal will be de-listed from the ASX but current CEO, Sean Senvirtne is set to retain a 20% stake in the company and will continue to lead the business. The Board of MyDeal has unanimously agreed on the transaction and recommends that shareholders vote in favour of the deal at their upcoming shareholder meeting.

“The transaction is a highly attractive proposition for MyDeal shareholders and represents a significant premium to MyDeal’s share price,” Senvirtne commented. “I am excited to retain a significant and continued interest in MyDeal and to lead the business through its next stage of growth to become Australia’s leading marketplace.”

Also happy with the acquisition is Woolworths Group CEO, Brad Banducci who said: “The addition of MyDeal to Woolworths Group represents a further step towards delivering a more holistic customer experience in food and everyday needs and materially expands our marketplace capabilities, especially in general merchandise.”

Somewhat behind the 8-ball, the retailer will now be positioned to take on the likes of Amazon, Kogan and Catch with an improved marketplace model which will target furniture, homewares and other bulky goods, plus Big W’s range of products. Woolworth’s already runs little known ‘Everyday Market’ which stocks products from partner retailers such as Big W and Pet Culture.

Woolworth’s decision to seek to acquire MyDeal is an interesting one, despite being years since main competitor Wesfarmers’ $230 million purchase of Catch back in 2019. It is worth noting that the Woolworth’s deal is taking place against the backdrop of whispers that Catch founders Gabi and Hezi Leibovitch may soon return to the helm following declining performance under Wesfarmers’ management. Since passing the baton in 2019 the former Catch CEOs have watched the Company lose $46 million in FY21 and $44 million in the first half of FY22, alongside revenue declines of 4.3%. Wesfarmers claims that the losses are due to investment in Catch’s team, technology and marketing but 3 years post acquisition that excuse is wearing thin.

It’s safe to say that Woolworths has learned from Wesfarmers’ mistakes, keeping the MyDeal wheels turning with their existing CEO in the driver’s seat, and keeping him incentivised with a chunky equity stake.

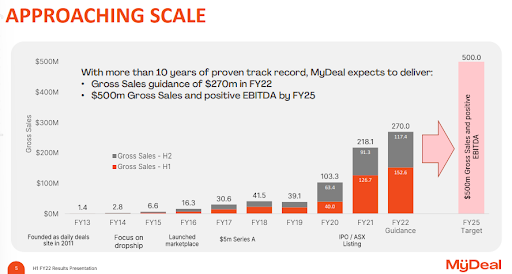

Since their IPO in 2020 MyDeal has seen sustained growth delivering quarter on quarter record gross sales, approaching a $500 million gross sales and positive EBITDA by FY25.

In the first half of 2022, MyDeal recorded a gross profit of $22.7 million, up 19.9% on the previous corresponding quarter, and reported a cash balance of $40.2 million.

With competition only increasing, the marketplace market is an interesting one for investors to watch.

- Parkinson’s UK backs Pharmaxis with $5 million to slow the onset of incurable disease with ‘ground breaking’ trial - September 1, 2022

- How this company is developing medtech to support Indigenous community health - August 22, 2022

- A round of ap-paws for PharmAust, changing the ruff prognosis for dogs with lymphoma - August 17, 2022

Leave a Comment

You must be logged in to post a comment.