When the market crashed in March 2020, the world economy saw its biggest fall since the GFC. Few would have anticipated a recovery within just 12 months, however that’s exactly what happened with governments jumping on the front foot with stimulus packages.

For Australia, it enabled the All Ordinaries to recover to its pre-pandemic levels (7200) in 12 months. Since then, it has continued climbing to now be trading around 7600. What made the recovery more impressive was the fact it took 12 years for the All Ordinaries to return to its pre-GFC level of 6500 in May 2019.

Comparatively, the impact of the pandemic and the majority of the world working from home; was just a blip on the economy. In many instances, COVID-19 strengthened the corporate world where operational expenses were slashed and employees produced more output but with a much healthier work-life balance.

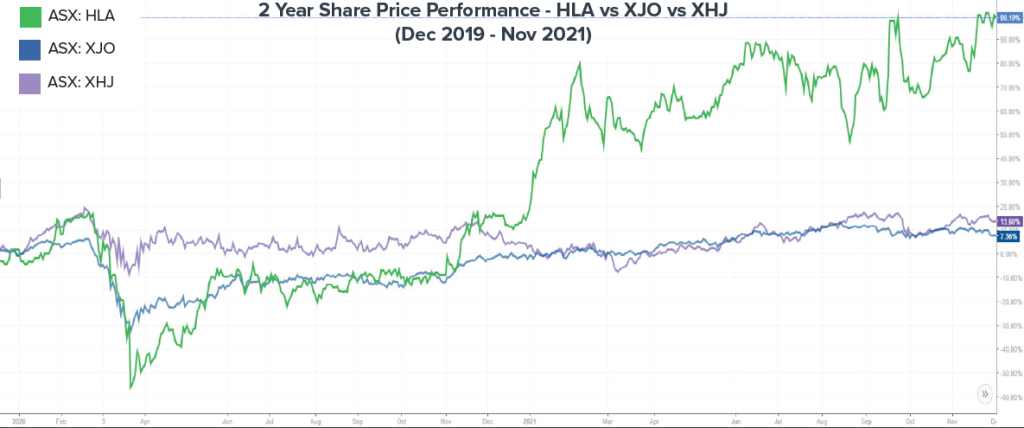

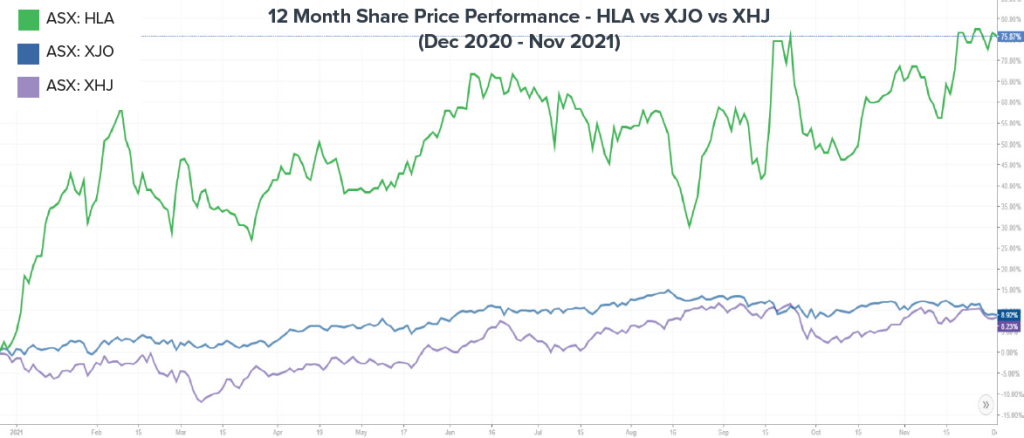

As would be expected in response to a pandemic, the S&P/ASX 200 Healthcare Index (ASX: XHJ, +13.6%) has outperformed the ASX200 (ASX: XJO), +7.36%) since the commencement of the pandemic.

In that same time, we have seen Healthia (ASX: HLA) blitz both indexes to emerge as Australia’s fastest growing allied health portfolio, to deliver a 99% gain in HLA’s share price.

Healthia has benefited from industry tailwinds where its services have throughout the pandemic been classified as ‘vital community services’ ensuring minimal disruption to its operations.

That said, the strong gains have been accentuated via Healthia’s growth strategy by acquisition coinciding with low interest rates which have seen the Company make major acquisitions of The Optical Company ($43m) and Back in Motion ($88.4m) during the pandemic.

At an industry level, Healthia appears to be benefiting from its profile as a publicly listed Company, openly disclosing the 9.1% organic growth across the Group in FY21.

At an industry level, Healthia appears to be benefiting from its profile as a publicly listed Company, openly disclosing the 9.1% organic growth across the Group in FY21.

Coupled with the difficulties endured by small clinic owners, this has given rise to increased interest in Healthia within the fragmented podiatry, physiotherapy and optometry sectors as vendors seek to alleviate themselves of back-office responsibilities by joining the Healthia network.

This has driven the acceleration of Healthia’s network growth through the pandemic where the increase in clinic numbers have seen a similar trend in HLA’s share price. This additionally was highlighted over the past 12 months where HLA (+75%) has comfortably outperformed the Healthcare Index (+8.2%) and ASX 200 (+8.9%).

At what point might we expect Healthia’s growth to slow down?

Healthia has continued to re-iterate its commitment to deploying $20m per annum to acquisition growth which excludes their major acquisitions where they have raised fresh capital in order to fund.

Working in the favour of shareholders, Healthia has at no point since their IPO sought capital to fund this acquisition pipeline, rather capitalising on the low interest rates and increasing their finance facility from $50m in 2018 to $100m in 2021.

Following the acquisition of Back in Motion Group, Healthia still had $33m of headroom in this facility but with their rising revenues and organic earnings growth, more acquisitions each year are being funded from existing cash flow, whilst still issuing shareholders with a 2.8% dividend yield.

The competitive lending landscape has provided Healthia to twice re-finance their facilities which have been extended to 2024 which, coupled with their free cash flow, should see another three years of acquisition growth at $20m per annum deployed without the need for fresh capital.

- Number of allied health professionals rising - January 9, 2023

- International Bank of Australia approved to launch Australia’s newest payments bank - November 7, 2022

- Novatti partnership allows more businesses to accept payments on the go - October 31, 2022

Leave a Comment

You must be logged in to post a comment.