The share market is forward looking they say, it is a pretty good predictor of the future economic activity. Why is that the case you might ask?

Well, there are thousands of profit-seeking and well researched investors and economists investing daily in the market with real money. Their collective opinion of the future economic conditions is reflected in the direction of the share market movements in the short term.

On that basis, the share market, so far, is down roughly -13% from its peak about a year ago and it is telling us that the economic conditions have turned for the worse. The market is not always right though, particularly when it tries to second guess the future economic manoeuvres of the central bankers and politicians. We don’t have to look far back for the evidence of the market’s miscalculation of the economic outlook when during the first breakout of the Covid-19 pandemic in 2020 saw the share market sell off nearly -35% only to recover just as quickly when it was clear the central bankers and governments were going to prop-up the economy in unprecedented ways.

What was the lesson learned? Expect central banks and politicians (let’s call them collectively as feds for the purposes of this article) to come out swinging if the economy does enter a serious recession. Each recession brings with it unique set of challenges but there is pretty strong evidence between Global Financial Crisis of 2008 and Covid-19 pandemic crisis of 2020, each very unique and unprecedented in their challenges, that the government & central banks end up responding to economic crisis with equally unique policies. Is this simply a blind faith in the Feds’ ability to rescue the economy in case the worst happens? Not really, feds can get it wrong but it is equally unlikely that the feds will just sit through a deep recession and shun immense public pressure to respond in significant ways. That being said, the feds may have greater appetite to sit through an economic slowdown or even a mild recession for the rest of this year so long as it serves to bring down inflation, which is the public enemy number one right now!

So, will there be a mild recession? The share market decline of approximately -13% so far is not indicating a recession but just much slower economic growth. While we do believe that the chance of a prolonged and deep recession is low as feds are your insurance against that scenario, it is worthwhile revisiting what a recession is.

In official economic language a recession is when there have been two consecutive quarterly declines in economic growth as measured by the Gross Domestic Product (GDP). It is just a fancy way of saying that the country has been producing less and less stuff for six months at least. Obviously when the economy produces less, there is less income earned nationally, and less requirement of resources by businesses e.g. labour, thus higher unemployment. For comparison, the last major recession we had in Australia lasted for over 12 months between 1990-1991. During that recession unemployment rose above 10%. The recession came in response to the unwinding of the asset price boom in Australia during the 1980s, the international recession of the early 1990s, and high interest rates, which were necessary to help reduce Australia’s high inflation rate at the time.

Yes, we also had an official recession during the Covid-19 pandemic in 2020 when Australia’s GDP contracted for two consecutive quarters ending March 2020 and June 2020 and in subsequent quarters the GDP bounced back hard. You may not strictly consider that to be a serious recession, although a lot of businesses and individuals did suffer extraordinary hardship at the time.

While the economy tends to grow over decades it never grows in a straight line, the economic journey over the long term is very much punctuated by ups & downs of business cycles. In business up-cycles people are growing their businesses, making money on the stock market, buying cars & houses, and feeling lucky. Sounds like the past ten years! But when the cycle turns down, the business activity and income fall across the nation. During this time companies are getting smaller, revenues & profits fall, workers are losing their jobs, and families are tightening their belts, and everyone is stressing out. That’s a recession.

The central bank’s role is to smooth out the extreme highs and lows of the business cycles by raising or lowering interest rates.

What are some warning signals of a recession? Overall, the warning signals so far in this slow down, we would say, are flashing amber light as opposed to an all-out red light. The real question is will we go from amber to red, or will there be amber conditions for the foreseeable future, will the amber conditions turn back to green, or will amber turn to red soon?

Based on the main data indicators we will share below we would conclude for now that the amber conditions are likely to continue for the foreseeable future i.e. a case of a muddle through economic condition (which are also referred to as stagflation i.e. stagnant growth and higher inflation).

The main indicators to watch are as follows:

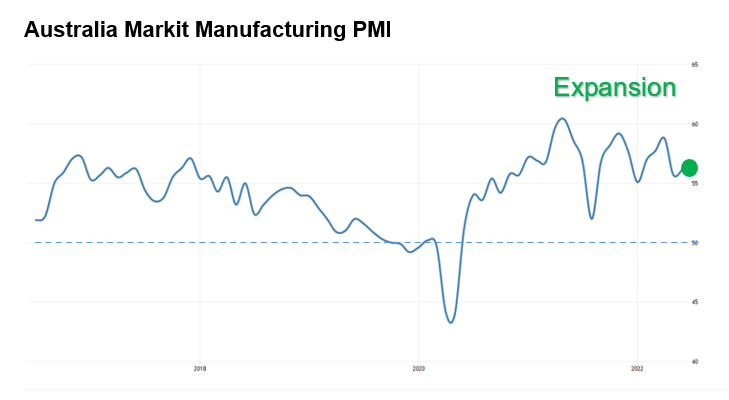

Firstly, a couple of positive indicators. The below chart (see top of next page) is illustrating current operating conditions in Australia’s manufacturing industry. Overall conditions are still positive and manufacturing businesses were still growing in May.

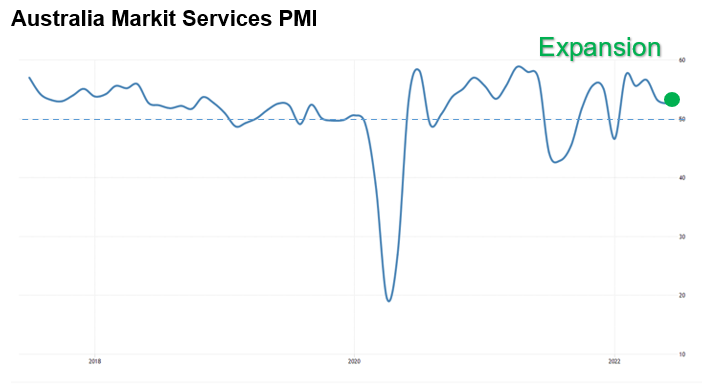

Secondly, while the services industry has been expanding the growth rates have been slowing for few months now, as last reported in May 2022 per the chart below. This includes activity in sectors like real estate, transport & storage, finance & Insurance. Companies in the services industry continued to expand their staffing levels to cater for demand surge after national borders re-opened. We feel, the staff shortage problem may ease in the coming months as the economy slows.

In regards to the above two indicators, please bear in mind these latest numbers are reporting conditions in manufacturing and services industries in the months leading up to and including May 2022, the indicators may well have deteriorated in June and July.

The next set of numbers point to a much sombre economic environment ahead.

Firstly, the residential & commercial construction industry’s composite indicator below includes data for sales, new orders, employment, deliveries and prices started to shrink as soon as the Reserve bank of Australia started raising interest rates in May. The faster the interest rates rise the worse the conditions will likely get for construction industry. A lot of trades & services sectors and even white goods retail rely on the construction industry to produce new houses for people to move in, keep the economy ticking along, and keep employment high.

Secondly, the consumer confidence indicator shown below has, well, tanked in May & June. Which is not entirely a bad thing because the RBA actually wants to instil the fear of the monstrous interest rate increases ahead. RBA wants consumers to help bring down inflation by spending much less on everything from essentials of life to the non-essentials.

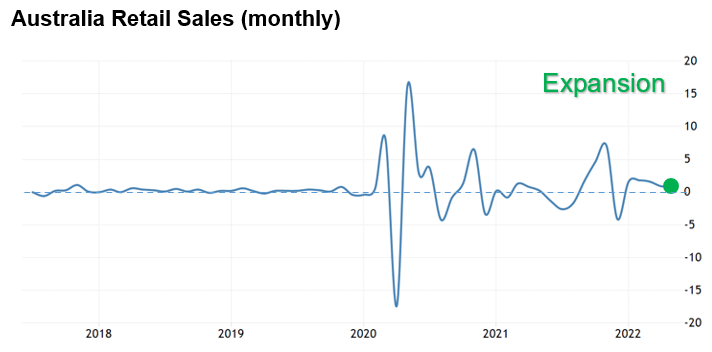

But entrenched spending habits take time to go away. Looking at the latest retail sales growth numbers below, it is clear that while consumers’ confidence in the economy is low, they are still not cutting back on spending enough to make a dent in inflation! And that is why you are seeing RBA continuing to push up interest rates until consumer spending actually starts to move down materially and slow down inflation, which is currently estimated at 6-7% p.a.

So, there you have it, a quick synopsis above of the most relevant economic indicators paint a mixed picture of the economy right now. The RBA is hoping to achieve a soft landing of the economic growth to more sustainable levels but their central banking comrades in the US have started to shift their language from a soft landing to a bumpy landing. We continue to expect a muddle through economic environment ahead. Investors with a long-term outlook will have opportunities in the months ahead to pick up stocks and assets at more attractive valuations, while conservative investors should seek to minimise the volatility in their income assets (to the extent possible) to help them ride through the current muddle through economy.

- Monthly Wrap: US attempting to quell China’s control on semiconductors and AI - July 9, 2024

- April 2024 Monthly Wrap: Economic growth slows to a near 2-year low as inflation growth delays interest rate cuts - May 10, 2024

- Monthly Economic Wrap: Rate cuts, a Chinese nuclear arsenal and impending TikTok ban - April 5, 2024

Leave a Comment

You must be logged in to post a comment.